Archive for January, 2013

Uber vs. PUC

Posted by Joshua Sharf in Business, PPC, Regulation, Transportation on January 29th, 2013

This past Saturday’s Wall Street JournalWeekend Interview was with Uber founder Travis Kalanick (“Travis Kalanick: The Transportation Trustbuster“). Uber allows a customer to summon an otherwise idle limo or SUV, on demand, through a smartphone app. The prices are competitive with town car service, and don’t require pre-arrangement. The article details, in part, Kalanick’s battles with various municipal regulatory authorities, who, often acting on behalf of established taxi interests, seek to keep his company from operating:

When I suggest to Mr. Kalanick that Uber, in the fine startup tradition, was using the “don’t ask for permission, beg for forgiveness” approach, he interrupts the question halfway through. “We don’t have to beg for forgiveness because we are legal,” he says. “But there’s been so much corruption and so much cronyism in the taxi industry and so much regulatory capture that if you ask for permission upfront for something that’s already legal, you’ll never get it. There’s no upside to them.”

…

Then, last year, came the clash with regulators in the city where they order red tape by the truckload: Washington, D.C. A month after Uber launched there, the D.C. taxi commissioner asserted in a public forum that Uber was violating the law.

This time Uber was ready with what it called Operation Rolling Thunder. The company put out a news release, alerted Uber customers by email and created a Twitter hashtag #UberDCLove. The result: Supporters sent 50,000 emails and 37,000 tweets. Mr. Kalanick says that Washington “has the most liberal, innovation-friendly laws in the country” regarding transportation, but “that doesn’t mean the regulators are the most innovative.” The taxi commission complained that the company was charging based on time and distance, Mr. Kalanick says. “It’s like saying a hotel can’t charge by the night. But there is a law on the books, black and white, that a sedan, a six-passenger-or-under, for-hire vehicle can charge based on time and distance.”

In July, the city tried to change the law—with what were actually called Uber Amendments—to set a floor on the company’s rates at five times those charged by taxis. “The rationale, in the frickin’ amendment, you can look it up, said ‘We need to keep the town-car business from competing with the taxi industry,’ ” Mr. Kalanick says. “It’s anticompetitive behavior. If a CEO did that kind of stuff—you’d be in jail.”

A determined PR campaign by Uber was able to derail DC’s efforts. By coincidence, this week, Uber posted on its Denver blog that the Colorado PUC is up to the same tricks:

Unfortunately, the Colorado Public Utilities Commission proposed rule changes this month which, if enacted, would shut UberDenver down. We need your help to prevent these regulations from taking effect! Sign the petition!!

Here’s a sampling of what’s being proposed (Proposed Rules Changes):

- Uber’s pricing model will be made illegal: Sedan companies will no longer be able to charge by distance (section 6301)

- This is akin to telling a hotel it is illegal to charge by the night.

- Uber’s partner-drivers will effectively be banned from Downtown — by making it illegal for an Uber car to be within 200 feet of a restaurant, bar, or hotel. (section 6309)

- This is TAXI protectionism at its finest. The intent is to make sure that only a TAXI can provide a quick pickup in Denver’s city center.

- Uber’s partner-drivers will be forced OUT OF BUSINESS — partnering with local sedan companies will be prohibited. (section 6001 (ff))

The PUC has run interference for the taxicab cartel here before, last year shutting down a popular airport ride sharing program. In 2011, they denied additional permits to Yellow and a proposed start-up, Liberty Taxi. And the Union Taxi Cooperative’s battle to begin service (eventually successful) was the stuff of legend. Their actions to the detriment of electricity ratepayers have been well-documented by Amy Oliver and Michael Sandoval over at the Independence Institute. But at least in those cases, they had the fig leaf of enforcing existing law. Here, as in DC, they’re actually proposing to change the rules in order to run the company out of town.

As a living, breathing example of regulatory capture, Colorado’s PUC is in a league of its own. Let’s hope that Uber’s supporters are able to persuade them to cease and desist their harassment of the company.

Is Legislative Stinginess to Blame for PERA’s Problems?

Posted by Joshua Sharf in Finance, PERA, PPC on January 28th, 2013

One of the favorite tropes of PERA apologists runs like this: PERA was fully-funded in 2001 or so, at which point the state legislature began failing to make 100% of its Annual Required Contribution (ARC). It was then that PERA’s funded level began to drop off. Therefore, if the state legislature had fully-funded the ARCs, today, PERA would not face a massive unfunded liability.

It’s a rhetorical masterstroke, redirecting blame for the current situation on a stingy state legislature that put PERA last in its priorities. And while grounded in a grain of truth, it severely understates and misattributes the nature of PERA’s financial crisis-in-the-making.

The grain of truth is this: the state legislature, beginning in 2003, began to under-pay its Annual Required Contribution. Of course, this affects not only the immediate year, but all future years going forward. Not only is the money from the shortfall not there, but the accumulated return on those dollars aren’t there, either. For this post, I’m just going to focus on the two largest divisions, the School Division and the State Division. They were combined in 1997, and separated again in 2006, so I’ll consider them as a unit.

Here are the yearly shortfalls, along with their future values to the end of 2011 (the latest year for which we have data). The first year for each underpayment is dollar-cost-averaged, so we give half the year’s return, and full yearly returns thereafter:

For 2003, the legislature underpaid by about $177 million, costing about $142 million in future returns, for a total effect in 2011 of $319 million. If you add up the total effect, year-by-year, you get the following result:

So by the end of 2011, the cumulative effect of 9 years’ worth of funding shortfalls is a little over $4 billion. The argument by PERA hinges on the fact that it’s at 2003 that PERA began to be underfunded:

As you can see, though, PERA was already suffering from poor 2001 and 2002 returns, even though there was no shortfall from the state those years. What did increase substantially was the size of the liability; the size of the assets actually held steady. From 2004 to 2007, solid returns managed to keep the dollar amount of the gap from growing. But then 2008 hit, and the size of the obligations continued to increase even as the fund got clobbered in the market. The liability dropped as a result of certain stop-gap changes that were made in 2009, but has since resumed its upward march, even as the actuarial value of the divisions’ assets has continued to fall.

Would it have made a difference if the state had made good on its entire ARC for 2003-2011. The answer is yes, but not very much. Adding in the cumulative shortfall each year, here’s the effect on the assets and the funded ratio for the State and School Divisions:

Despite some increased, they’re still seriously underfunded. Since it’s difficult to see the difference between the two charts, I’ve made the comparisons here. First, the difference in assets:

An increase of total assets from $31 billion to $35 billion is not nothing, as they say down at the station, but it’s also not nearly enough to start to close the gap with liabilities. So little that the difference in funding ratio barely moves the needle:

For those of you who want it all on one chart, possibly for optical exams, here it is:

In reality, it’s worse than this. Prior to 2006, PERA didn’t report a sensitivity analysis on its assumed rate of return, so we have only the values for 8%. If we assume a more realistic 6.5% return going forward the unfunded liability grows from $25 billion to about $40 billion, and the extra $4 billion makes even less of a dent.

PERA isn’t suffering from a legislature that isn’t keeping its promises, it’s suffering from having made promises it can’t keep. And it’s the very PERA members who are going to get hurt the most, the ones who’ve been sold a bill of goods about what’s waiting for them when they retire.

Mixed Feelings About UN Holocaust Remembrance Day

Posted by Joshua Sharf in History, Israel, Jewish on January 27th, 2013

Today is the UN’s annual Holocaust Remembrance Day. It’s commemorated on January 27, the anniversary of the liberation of Auschwitz by the Red Army, and is generally pointed to, even by UN critics, as one of the few things that the UN gets right. For its admirers, the day pretty much absolves the UN of all sins.

I confess to having mixed emotions about it.

First, there’s the tendency towards universality that pervades everything Jewish-related that the UN does. The Holocaust has a specific, unique meaning to Jews that it doesn’t have to anyone else. This is a result of the special place that Jews held in Nazi ideology, and therefore the uniquely catastrophic results that the Holocaust had on the Jewish population and civilization of Europe. This point has been made before, but the need to draw universal lessons from a uniquely Jewish experience has the effect of lessening, rather than deepening, the lessons that we actually draw from it. It’s much easier, much more banal, to oppose “hate” in the abstract, than it is to look at the much more concrete way that a specific person or people is seen.

That universality has been the Trojan Horse by which, ironically, anti-Semitism has been given a new lease on life, when the Holocaust was supposed to have rendered it inert for all time. As British Chief Rabbi Jonathan Sacks has repeatedly pointed out, anti-Semitism is a virus, that mutates into whatever form the current zeitgeist finds most acceptable. Currently, racism is the one thing that can’t be tolerated. Therefore, it is convenient to condemn Israel – and Jews – for supposed racism vis-a-vis the Palestinians. Rebutting those charges is well beyond the scope of this blog post, and well-nigh impossible in the eyes of those who make them in the first place. But the charge of racism, accompanied by the de rigeur comparisons of 2013 Israelis to 1943 Germans, is what has allowed anti-Semitism to regain respectability within the Left. It will provide the cover for the very same diplomats shedding crocodile tears over the dead Jews of 70 years ago to condemn the living Jews of today for resisting a repeat of history.

In fact, there already is a Holocaust Remembrance Day in Israel, Yom HaShoah, and it celebrates life, vitality, resistance, and renewal, rather than the passive liberation and victim-status that the world prefers for its Jews. Two days were considered – first the anniversary of the Warsaw Ghetto Uprising, 14 Nissan. That was rejected because of its proximity to Passover. Instead, Yom HaShoah is commemorated a week before Yom HaAtzmaut, Israeli Independence Day. Either one of those would be just fine for a UN Holocaust Remembrance Day, but either would make more difficult the UN’s current mission of demonizing and dispossessing the Jews of their national homeland.

If a Day of Liberation of the Camps were strictly necessary, perhaps the anniversary of the liberation of one of the camps by Eisenhower, who actually commissioned films to be made in order to perpetuate the awful memory of what happened. Instead, we get the liberation of Auschwitz, the Symbol of Symbols of the Holocaust, but one which was also liberated by the Red Army, which turned out to be in many ways, not much better than the Wehrmacht, and was servant to an ideology in every way the equal of Hitler’s.

Perhaps more ironically, there is a way to redeem this date specifically with respect to Jews. In 1945, as in 2013, it falls on Parshat Beshallach, the week where Jews read of the crossing of the Red Sea and the destruction of Pharaoh’s armies. Carrying the story a little further, we also read of the Amalekites attacking the Jews in their new sanctuary, with the intent of annihilating them, and the Jews’ success in fighting them off.

Don’t count on too many people pointing out those parallels.

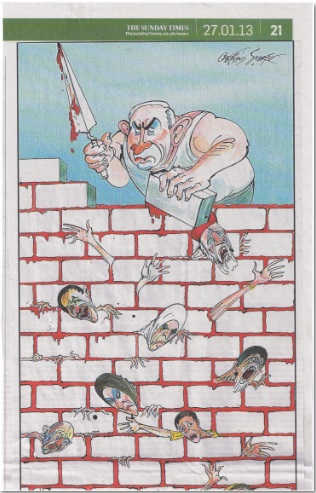

UPDATE: As if to make the point, here’s a front-page cartoon from this morning’s Sunday Times of London:

Lowering the Hill

Posted by Joshua Sharf in Budget, Colorado Politics, PERA, PPC on January 23rd, 2013

Ultimately, large changes will be needed to keep PERA solvent. But little changes can have an effect, too. Today, the state House Finance Committee will be hearing HB13-1040 from Republican Rep. Kevin Priola:

Current law averages the 3 highest annual salaries of a member of the public employees’ retirement association (PERA) when calculating that member’s retirement benefit amount. The bill increases the number of highest annual salaries used from 3 to 7 for anyone who was not a member, inactive member, or retiree of PERA as of December 31, 2013.

In 2010, SB1 changed some rules to make it more difficult for employees to suddenly spike their salaries and other compensation at the ends of their careers, in order to game the system and maximize their PERA benefits. For instance, for benefit calculation purposes, raises and other increases in compensation – like saved vacation being cashed in – were limited to 8% in any given year. Employees could receive larger raises, but benefits could only be calculated on the first 8% of the increase.

This bill would make it even harder to game the system by averaging the highest seven years’ compensation instead of the highest three. It’s a reasonable measure, and it would only apply to employees who join PERA after the end of this year. The Democrats enjoy a large majority on the Finance Committee, so they may well kill the bill. But the fact that it got assigned to the Finance Committee at all, rather than relegated like SB13-055 to the State, Veterans, and Military Affairs Committee, makes the outcome less certain.

Democrat Sen. John Morse Follows Familiar Pattern On PERA Reform

Posted by Joshua Sharf in Budget, Colorado Politics, PERA, PPC on January 23rd, 2013

The state Democrats, led by State Senate President John Morse (D-Colorado Springs), are continuing their deeply unserious approach to Colorado’s massive unfunded PERA liability this session. Incoming Speaker of the House Mark Ferrandino (D-Denver) had already indicated as much, first by characterizing those who would seek to deal with the problem as wanting to use the economic situation as an excuse to take away public employee’s pensions, and then by appointing Lois Court (D-Denver) as Chairman of the House Finance Committee.

The latest sign comes with respect to a bill proposed by Republicans Sen. Kent Lambert of Colorado Springs and Rep. Lori Saine, a freshman Republican from Dacono. The bill, SB13-055, would require PERA to use the state’s long-term borrowing interest rate as the discount rate for its liability, and would require that the CAFR be released by May 31 of each year. It would also require that contribution and/or benefit levels for any individual fund be adjusted when the amortization period for that fund climbs beyond 30 years.

All of these are eminently reasonable proposals. For reasons discussed before, the discount rate should be the required rate of return of PERA’s investors, the members. There is also no real reason why PERA can’t produce a CAFR within five months of the end of the calendar year; those dates have been slipping in recent years, but the fact is, the bulk of the CAFR is boilerplate or easily-written text, and the same financial statements and charts each year. And since the stated goal of PERA is to be within a 30-year amortization window, requiring them to be so would simply put teeth into an existing target.

Yet Sen. Morse has chosen to assign the bill not to the Senate Finance Committee, which has jurisdiction over PERA oversight, but to the State, Veterans, and Military Affairs Committee. That committee, often referred to as the “kill committee,” is traditionally staffed with the most partisan members of both parties, and used to kill inconvenient bills. Often that’s because “no” votes on the bills might be embarrassing to the majority, perhaps sufficiently embarrassing that some members wouldn’t be able to resist the temptation to vote for them.

That Senate President Morse has chosen to put this bill in front of the kill committee is practically an admission of its common sense, and his lack of it, but it does make clear the two halves of the Democrats’ full-court defense of their public employee clients’ pension plans.

First, they’ll protect them from any votes they might lose, and also protect the House and Senate Finance Committee members from having to cast “No” votes they’ll later have to explain.

Second, both Ferrandino and Morse have claimed that 2010’s SB1 “solved” the PERA problem for good, though tremendous liabilities remain, even given the plan’s own overly-optimistic assumptions and accounting practices. That will be their explanation for dodging these votes, but even if true, it’s a non sequitur. If PERA is truly fixed, surely members of the committee charged with its oversight would not only be the best-informed of that fact, but also best able to explain it to constituents. Putting the bill in front of a committee whose actual charter has nothing whatsoever to do with PERA, and whose reputation is one of chief enforcer, can’t inspire much confidence that the Democrats will be dealing with the state’s financial problems in good faith in the next two years.

The Hill Gets A Very Little Less Steep – For Now

Posted by Joshua Sharf in PERA, PPC on January 22nd, 2013

One of the main points of contention about PERA has been the expected rate of return. Up to 2001, PERA used an expected rate of return of 8.75%, but lowered that to 8.5% from 2002-08, and again to 8% in 2009, where it now stands.

So how has PERA done since 2001, when it stood at a 100% funding level? The chart below shows the annual return over those 11 years for which they’ve reported, plus an estimated return based on a similar portfolio from CalPERS, the California pension plan. CalPERS has a .99 correlation with PERA, which is about as close to metaphysical certainty as anything human gets. In 2012, CalPERS reported a 13.26% return, which would project a 13.9% return from PERA, so just for grins, I’ve plugged that into the 2012 spot.

The red line is the running CAGR from 2001, or Cumulative Average Growth Rate for 2001 through the current year.

As you can see, over time the red line becomes less volatile, as more years are factored into the average.

The green and purple lines are where it gets interesting. Those lines are the return that PERA would have to see over the remainder of the 30-year window from 2001-2030, in order to meet the 8.75% and 8% targets. So, for instance, after 2007, in order to have a CAGR of 8.75% from 2001-2030, PERA would have to have returns of 9.3% from 2008-2030.

Note that using the 8% return from 2001 basically gives hindsight credit to PERA, since in 2001 they were projecting 8.75%, not 8%. Let’s blow up that part:

As you can see, PERA started out with poor 2001 and 2002 returns, which put it in an immediate hole. Even good returns from 2003-2007 only got the required returns down to 9.3% and 8.3%, respectively. Then 2008 happened. By now, we’re 12 years into that 30-year window, and even a good year like 2012 will only push the required return down a little bit, about 0.3%. For instance, it would take 7 years of 15% returns to get the required return for the 8.75% line down to below 8.75%, in effect, to catch up to the 8.75% projection, and it would take 5 more years to catch up to the 8% projection. It’s highly unlikely that even 5 years will pass without a normal, cyclical recession, and attendant lower returns.

The average return is 6.28%, the CAGR is lower, just over 5%. In fact, any set of returns with an average of 8%, but which are not actually 8% each year, will compound to less than 8%, making it that much harder to make up ground. Bear that in mind when someone talks about how easy it is to make up for a couple of bad years.

All of this argues for using a Monte Carlo simulation to determine solvency, rather than a simple rate of return. Such a model is a little more expensive to run, but will give a far more accurate picture of the health, or lack thereof, of any defined benefit plan.

PERA – It’s All For The Kids

Posted by Joshua Sharf in Education, PERA, PPC on January 20th, 2013

Not all school spending is for the kids. A lot of it is for the teachers, at the expense of the kids. Over the last five years, even as school districts and teachers unions complain that per-student spending has been “slashed,” “cut to the bone,” or “eviscerated,” per-student spending on the PERA School Division has been growing well beyond inflation. Here are the per-student contributions by the major local school districts (minus Denver, which has its own PERA division), and statewide:

Over the least 5 years, this has translated to growth rates well in excess of inflation:

And who’s been picking up the tab? The Employer contribution has been growing far in excess of the Employee contribution in absolute terms. The employer contribution has been growing at 10% per year from 2006-2011, while the Employee contribution has grown at a 3% rate over the same period. The overall per-student increase has been just under 8.5%.

Not only is PERA taking money from the classroom, it’s taking taxpayer dollars from the classroom at a wildly disproportionate rate. Is this what the teachers unions mean by “shared sacrifice?”

Daily Glimpse January 17, 2013

Posted by Joshua Sharf in PPC on January 17th, 2013

Daily Links From Glimpse From a Height

- The Moral Case for Conservatism

Arthur Brooks, President of the American Enterprise Institute, is the most articulate advocate out there for the moral and community case for capitalism and fiscal responsibility. In Tuesday’s Coffee and Markets podcast, he presents the case about as succinctly as I’ve heard it made, perhaps as succinctly as it can be made. Key to his worldview […]

- Benford’s Law Wins Another Round

There are more quantities that start with 1 than start with 2. Those that start with 2 in turn outnumber those that start with 3, and so on. This is true for just about every measurement – from the size of asteroids to financial ledger entries to economic statistics. Why? Because there are more small […]

Dems Try to Tar Republicans With…Slavery?!?

Posted by Joshua Sharf in Civil War, History, National Politics, PPC on January 17th, 2013

Gawker seems to think it has a scoop of some kind, trumpeting the fact that the Republicans are meeting in the Burwell Room of the Kingsmill Resort (named for a formed slave plantation) to discuss – ta da! – minority outreach. The irony, the sheer hypocrisy of such a thing is apparently too much for them to bear. And local DU polisci professor Seth Masket, on Twitter, is equally enthralled.

Let’s remember that the GOP is the reason that neither Burwell Plantation nor the location of the resort are slave plantations any more. Masket knows this, but still thinks that somehow the GOP is tarred by association with slavery.

Of course, the Democrats have been holding retreats there for years (1998, 2007, 2008, 2009 – where President Obama spoke), and President Obama did his 2nd debate prep there this past year, without anyone commenting on the location. There’s a good reason for that – it doesn’t matter. Many fine resorts in the south are located on former plantations; it’s a good use for the land. That it was a plantation 150 years ago should be cause for celebration.

If anyone has reason to be embarrassed about holding meetings there, it’s the party of slavery and secession, not the GOP.

Daily Glimpse January 16, 2013

Posted by Joshua Sharf in PPC on January 16th, 2013

Daily Links From Glimpse From a Height

- The Libya Fallout Spreads

Walter Russell Mead notices that the French may have bitten off more than they can chew in Mali: France needs US help, and the US should give it. Just as France’s Libyan intervention failed because the country ran out of military supplies, France’s Malian adventure could collapse without our support. But the situation nevertheless raises alarms. I […]

- So Much for Red Lines

Chemical weapons used in Syria? United States diplomats in Turkey conducted a previously undisclosed, intensive investigation into claims that Syrian President Bashar al-Assad used chemical weapons, and made what an Obama administration official who reviewed the cable called a “compelling case” that Assad’s military forces had used a deadly form of poison gas. The cable, […]

- A Debt Ceiling Negotiating Strategy

Keith Hennessey has some suggestions for how the Republicans should approach the debt ceiling: He is afraid of getting jammed by small short-term debt limit increases (as I have recommended). Really afraid. This path would keep fiscal issues front-and-center when he wants to punt them, and it would force him to pay a price every […]