Archive for August, 2012

Investing in School…Bonds

Posted by Joshua Sharf in Colorado Politics, Education, Finance, PPC on August 16th, 2012

I’ve written before about the proposed Jefferson County Schools mill levy increase, issues 3A and 3B, which will be on the ballot this fall. The committee supporting the measure is named Citizens for JeffCo Schools (sic), and according to EdNews Colorado (confirmed by TRACER documents), it has raised a little under $50,000 this year. Twenty thousand of that comes from Robert W. Baird, an investment bank based in Wisconsin. Another $15,000 has come from FirstBank, meaning that the remainder of small contributions – under $15,000 – is less than the $15K from FirstBank.

Robert Baird, as it turns out, is the district’s investment banker, confirmed in the minutes of the June 14 School Board meeting (available here). This means that should the bond pass, Baird stands to make a fair amount of money underwriting the refi.

This cycling of money by investment banks back into bond referenda that they stand to benefit materially from is extremely distasteful, and has gotten attention before.

Someone should ask the 3A/3B proponents about this.

UPDATE: Go to JeffCo Students First Action to see what you can do to stop this measure.

How Does PERA Rate?

Posted by Joshua Sharf in Budget, Colorado Politics, Finance, PERA, PPC on August 15th, 2012

Not well. According to its latest Comprehensive Annual Financial Report, PERA has an unfunded liability of $25 billion, up from $15 billion last year, mostly because of a dismal rate of return in 2011, roughly 1.9%. Much of the criticism of public pensions has centered on their unrealistic expected rates of return, 8% in PERA’s case. This is certainly a cause of concern. While 8% is not unrealistic for equities historically, most people consider it to be wildly optimistic, certainly for the near future. And in any case, a constant rate of return doesn’t take into account the volatility of those returns.

But there’s a second rate, the discount rate, which PERA also has to estimate. It signifies something else altogether, and like the discount rate, PERA’s assumptions regarding the discount rate serve to make the fund look more solvent than it actually is.

What is a discount rate?

Another term for the discount rate is the “required rate of return,” not by the plan, but by the investors in the plan. In some sense, you can think of it as the Rate of Return in reverse.

The Rate of Return is used to estimate how much today’s investment will be worth tomorrow. PERA assumes an 8% rate of return, and for the moment, let’s humor them. This means that $1,000 today will be worth almost exactly $10,000 in 30 years.

The discount rate works in reverse. If I know that I’m going to need $10,000 in 30 years, then I can run that number in reverse, discounting by 8% each year, until I see that I need $1,000 in the bank today to be able to meet that obligation.

PERA, like most government pensions, uses the assumed Rate of Return as the Discount Rate. If you have $1,000 in the bank, after all, you have enough to cover a $10,000 obligation.

Why not?

Because in this case, the discount rate is supposed to discount back obligations, not assets. It is suppose to represent the required Rate of Return of the investors, in this case, the pensioners. And since the pensioners’ assets (their PERA benefit) is the same as PERA’s obligations, PERA should use the Rate of Return that pensioners should expect on their investment.

What rate is that? Basic economics says that risk needs to match return. The market should price assets with the same risk at the same Rate of Return. Otherwise, for two assets with the same risk, an investor could sell the one at the lower rate of return, and buy at the higher rate, and not have any risk at all. Obviously that’s not sustainable.

So the trick is to find an investment with roughly the same risk as PERA, and use its return as PERA’s discount rate. PERA is a contractual obligation by the state, much like a long-term bond. It can probably change the terms of PERA more easily than it could default on a long-term bond, but again, let’s assume that these are pretty close to having the same level of contractual obligation, and therefore, from the investors’ point of view, the same risk.

This is what private pensions have to do. A corporate pension would use, as its discount rate, a mix of high-quality corporate debt, because that’s market-traded debt at the same level of obligation as its pension obligation. It’s only by the grace of the Government Accounting Standards Board (GASB), that PERA and other public pensions can get away with the higher discount rate.

Right now, according to MunicipalBonds.com, Colorado has long-term revenue bonds trading between 4,5% and 5%. Conveniently, if we use 4.75%, a $10,000 obligation translates to $2500 today.

So What Does This Mean?

Well, in our example, it shows how the level of fundedness is dependent on the choice of discount rate regardless of whether or not the 8% Rate of Return is realistic. If PERA has $1,000 in stocks, and chooses a discount rate of 8%, it looks as though it’s fully-funded. But if PERA is forced by accounting standards to choose the (more correct) discount rate of 4.75%, it’s underfunded by $1500, and is only 40% funded – even if we can realistically expect 8%.

That’s because the two rates really don’t have anything to do with each other. One is the rate of return PERA expects on its assets from its own investments. The other is the rate of return that pensioners expect on their investment. What PERA invests its money in is a policy decision. It may be good or bad policy, but pensioners expect to be paid, just the same as bondholders do, and that’s what determines the riskiness of the pension as an investment, not whether or not management puts it in gold bars or decides to go to Vegas and put it all on Red.

Ideally, PERA would match its return to its obligations. It would invest at something that also returned 4.75%, and have $2500 in the bank to be able to cover the $10,000 obligation, 30 years from now.

When it’s allowed to select a higher discount rate, though, it can get away with looking fully-funded with a much less money. Obviously, it has every incentive to do that. To do that, it has to seek investments with higher expected return. But in chasing higher returns, it’s also taking on additional risk.

Not only does the higher discount rate make PERA look more solvent than it is. It also encourages it to make riskier investments with its pensioner’s money.

JeffCo Unions on PERA – Watch What We Say, Not What We Do

Posted by Joshua Sharf in Colorado Politics, Education, PPC on August 10th, 2012

This year, Jefferson County Public Schools will be seeking – yet again – a mill levy increase that will reportedly raise $39 million. There are two measures on the ballot: 3A, which will fund operations, and 3B, which will be used to fund capital improvements.

Sheila Atwell, JeffCo parent and president of JeffCo Students First has been leading the opposition to the increase. On July 20, 2012, she and Cindy Stevenson, Jefferson County School Superintendent, debated the measures at the Arvada Chamber of Commerce Leadership Breakfast. During the discussion, Atwell raised the explosive growth of PERA costs to the district over the last few years.

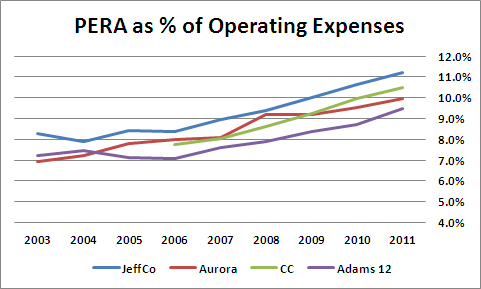

As can be seen in the chart below, Jefferson County is not alone in seeing PERA absorb a greater and greater proportion of its operating budget:

Using reasonable growth rates, Mrs. Atwell projects that within a few years, PERA will eat up 20% – one dollar in five – of Jefferson County’s operating expenses.

Supporters of 3A an 3B have responded that PERA contributions are set at the state level, that neither the county nor the school board have any control over them, and that for that reason, they are irrelevant to the debate over 3A and 3B. Dr. Stevenson had this to say in response to a question about PERA reform at the breakfast:

“As far as PERA goes, it’s a worthy debate to have as a state. We can have that debate. That’s a good thing for a state to debate: how are we going to manage this? But, at the end of the day, we have to pay our share. We are not opposed to reform. Our employees aren’t opposed to refom. But we also have to remember those great starts and strong finishes in the meantime. How are we going to support our kids in their classrooms? And at some point as a state, we’ll untangle this.

“So, yes, it is legislative. Yes, we have to follow the law. Yes, all of those things. But it’s in our budget. We’re gonna pay it no matter what. So, I don’t think PERA is the issue for 3A/3B. It may be an issue, but it is not the issue for 3A/3B.” (Emphasis added.)

Defusing an objection by simultaneously feigning flexibility while maintaining its irrelevance is a classic strategy for dealing with a dangerous issue, and in fact, that’s exactly what Dr. Stevenson is doing here. In fact, both assertions are demonstrably false.

In 2012, four major PERA reform bills were introduced into the legislature:

- SB12-016, which would have given local governments the ability to shift up to 2% of the employer contributions to employees, something the state government can already do

- HB12-1250, which would have tied PERA employer health care contributions to expenses, rather than to employee salaries

- SB12-082, which would have raised the PERA retirement age to that of Social Security

- SB12-119, which would have required PERA to adjust benefits and contributions to keep the amortization period for benefits at or under 30 years

All are moderate measures. None was passed. In fact, none even made it to a floor vote. A lobbyist search shows that each was opposed by some combination of AFT, the AFL-CIO, the CEA, or CASE (the Colorado Association of School Executives). Jefferson County teachers are represented by the JCEA, the county branch of the CEA. The AFT and AFL-CIO jointly run the Colorado Classified School Employees Association, the union for the administrative staff. And CASE presented Dr. Stevenson with its 2010 Superintendent of the Year Award. It’s quite clear that, contrary to Dr. Stevenson’s assertions, JeffCo public school employees – or at least their representatives – are solidly opposed to PERA reform.

As for the Board itself, the unions have been active in school board races for at least that several cycles. A TRACER search reveals that two of the Board members, Paula Noonan and Jill Fellman, received considerable union financial assistance in their election campaigns, while Linda Dahlkemper is the wife of former Congressional candidate Mike Feeley, so was evidently well-connected on her own, and able to raise enough money from the Democratic establishment. (In fact, a number of current and former Democrat officeholders were prominent contributors to her campaign.) And the union contributed several thousand dollars to the losing 2009 campaign of Sue Marinelli. It would be unreasonable to expect board members, some of whom likely hold their seats as a result of union support, to support reforms so strongly opposed by their campaign benefactors.

It is the height of disingenuousness to claim that the solution to PERA is at the state level, and to claim that the district has no flexibility in dealing with it, and then to oppose those very reforms, including one that would have explicitly given the Board the very flexibility it says it doesn’t have. (In fact, the Board and the unions are always at liberty to negotiate changes to the employer-employee contribution mix.)

Dr. Stevenson claims that because of that inflexibility, PERA contributions are set by the state, so 3A& 3B are irrelevant. However, the reason that JeffCo is pursuing a mill levy increase this year is that in December, the district finished paying off a bond issue, and the Board wants to hold onto that revenue stream, so that it doesn’t have to come back to the voters and ask for the entire mill levy increase. Instead, it can apply the existing bond mill levy to the proposed increase, making the apparent increase smaller. In theory, a mill levy dedicated to debt can only be used for other debt, once the initial bond is paid off. In reality:

“What [those proposing the increase] realized was we had a unique opportunity right now to get money into our classrooms for great teachers, great education, and not increase your property taxes to an extreme level. Here’s why we have that opportunity. We are going to be paying off bonds in December, that’s true. That equals about 4.75 mills. Now, there’s nothing in statute that says the Board has to refund that. We can do that, or we can apply it to other debt. Sheila is right: you can’t move bond mills – that’s the way I think about it – to operations. However, we can look at the total mill increase.” (Emphasis added.)

Dr. Stevenson all but admits that the right way to think about the JeffCO school budget – any budget, in fact – is to consider it as a whole. Money not used for debt reduction can be applied to operations. Or PERA.

Whenever a government asks for a tax increase, it’s sold on the basis of things like “great starts and strong finishes,” but much of the time, ends up going to feather the nest of those proposing it. Mrs. Atwell has correctly identified the source of a large and growing structural gap in JeffCo’s school financing, one which ought to be addressed before asking the public to turn over more money to the district.

UPDATE: Go to JeffCo Students First Action to see what you can do to stop this measure.

Keep Your Pols Off Our Souls

Posted by Joshua Sharf in PPC on August 7th, 2012

After Sunday’s murders at the Sikh temple in Wisconsin, President Obama wasted less time than he has before in making it a target of political opportunism concerning gun control. He called for a national “soul-searching” about ways to end gun violence. (This prompted Instapundit to point out the lack of Presidential self-soul-searching regarding the hundreds left dead by Fast and Furious.)

The phrase rang a bell, and indeed, this wasn’t first time that Obama has found himself concerned about the state of the nation’s soul. In his statements after Trayvon Martin was killed, Obama said that “all of us have to do some soul-searching,” (1:13 in the embedded video). During the college basketball game on the USS Carl Vinson, the President took time out to admonish “all institutions” to do some soul-searching over the Jerry Sandusky situation at Penn State (0:48):

In 2011, he questioned Israel’s sincerity in its commitment to peace, saying that Jewish and Israeli leaders needed to “search your souls” about their seriousness.

Previously, in closing his much-ballyhooed Health Care Summit, intended to simultaneously browbeat and co-opt Republican opposition to Obamacare, the President told Republicans:

Of course, we might have seen this coming. During the campaign, Michelle Obama comforted us with the news that Barack Obama, in order to prepare us to tackle the tough challenges ahead, would be able to fix our souls (3:18).

The Health Care Summit was relatively early in his administration, so the concern might have been warranted. But surely, by now, our souls ought to have been fixed?

Swing States & National Elections

Posted by Joshua Sharf in 2012 Presidential Race, National Politics, PPC on August 3rd, 2012

In my comment yesterday, I noted that in my experience, campaigns that find themselves behind in the national polls, but believe they can win by targeting only swing states, are generally losing campaigns. You might be able to pull that off if the difference is less than 1%, but nobody is going to win the Electoral College while losing the mythical national popular vote by 3%, as Rasmussen has consistently had Romney leading Obama by.

Comes this from Bill Kristol at the Weekly Standard, quoting an election-savvy friend of his:

“The national numbers aren’t changing much because Romney is actually gaining in the states that are not being bombarded with media. Yesterday’s Connecticut poll has Obama by only 8 for example. And red states seem to be getting even redder. This is happening because the daily news is about the economy, Washington problems, etc. and that is the main message getting through. So, polls in these states reflect how voters who only see national news and national advertising (to the degree there is any) respond.

…

“One can draw a lot of different conclusions here—but doesn’t it seem likely that the Obama attack on Romney is working where it is deployed in full measure? I think many analysts have erroneously concluded that because the national tracking has not moved, the Obama attack on Romney’s wealth, Bain, taxes, etc. is not effective. The results in these states suggest otherwise.”

Hidden in here is the reason that, barring something that shakes up the race, it’s a losing strategy for Obama. If the overall national trend is in favor of Romney, light blue states will tend to move to toss-up, while he consolidates his hold on the toss-up and lean-Romney states that Obama isn’t advertising in.

Faced with having raised less money, Obama is staying in the game only by virtue of outspending Romney in key states. This puts him in a position similar to that of McCain four years ago, who was practically invisible on the air towards the end of the campaign. Obama won’t be invisible, but he’ll be at a money disadvantage.

So Obama will find himself having to play defense in more and more states, with less and less money to do so. That’s why campaigns that go tactical this early in the process tend to lose.

It’s certainly possible that the national media will pick up on and repeat the Obama campaign message in the newscasts, but to be honest, I’m not sure how that really changes the nature of their coverage from where it is now.

Usual caveats apply, but it certainly looks as though this is a re-election campaign that knows it’s in trouble.

Denver Mayor Michael Hancock’s Lack of Vision

Posted by Joshua Sharf in Colorado Politics, Denver, PPC, Taxes on August 3rd, 2012

The following is a Guest Commentary published this morning in the Denver Post. For the uninitiated, since 1992, Colorado has had a law on the books called TABOR, or the “Taxpayers Bill of Rights.” The bane of tax-raising legislators statewide, it limits revenue growth to inflation + population, year over year. In the case of cities, this means that a city may only be entitled to keep a portion of the mill levy on a property’s assessed value, returning the rest to taxpayers. TABOR includes a provision known as “De-Brucing,” after TABOR author Douglas Bruce, whereby the residents of a district may opt out of those limitations, and allow the city to keep the full mill levy on the entire assessed value of a piece of property. To date, Denver has not done so, and this year, Mayor Michael Hancock is proposing that the City Council approve a referendum for Denver citizens to do just that.

At the invitation of the Independence Institute, I wrote the following piece, opposing the proposed tax measure:

UPDATE: The Post edited the piece somewhat for space. An earlier version of this post just used what they printed. I’m replacing it here with the slightly longer version that was submitted to them.

Denver’s a big city, a major element of Colorado’s economy, and of the Rocky Mountain West. And its governance is not for the faint of heart. But the Hancock Administration is not asking the hard questions, Instead the administration is seeking the easy way out of a budget deficit through a proposed permanent property tax increase for the November ballot.

Instead of proposing bold changes to Denver’s fiscal structure, Mayor Hancock has opted to tinker around the edges of city finances, and stick Denver homeowners with the bill for his lack of vision.

Denver is just beginning to recover some of its housing value. Yet, only a month ago, the Denver Post reported that “another wave of foreclosures appears to be looming.” A sudden increase in property taxes strikes at the heart of households’ precarious financial stability, even as government take a bigger bite of homeowners’ slowly increasing equity. Renters would also be affected, as property owners pass along the increased expense.

The mayor’s proposal assumes that rising home values necessarily mean rising incomes. But the Bureau of Labor Statistics reports Denver’s weekly income fell nearly 5% in 2011, 305th out of 323 major counties surveyed. The mayor’s mill levy override scheme would mean an immediate property tax increase of 20% for households who are still finding it difficult to make ends meet.

Denver’s unemployment rate remains stubbornly high, at 8.7%. The Mayor’s Structural Financial Task Force cites a failure to create jobs as one reason for lower revenues. That’s hardly a reason to penalize the employed and unemployed alike.

Another of the mayor’s proposals, eliminating the business personal property tax for new purchases, is a smart and welcome revenue enhancing move, but merely shifting the tax burden from struggling business owners to struggling families – often the same people – will leave us no better off.

When the government proposes a tax increase, it’s claiming that the least important thing it can do with that money is more important than the most important thing you can do with it.

Many households’ finances are just beginning to stabilize after years of uncertain employment. People have savings to rebuild, retirements to plan for, and children to feed, clothe, and put through school. Maybe even take the odd vacation they’ve been putting off for years.

The government has a moral obligation to exhaust all reasonable efforts at cost savings before asking taxpayers for more. But the mayor hasn’t just “gone small” on savings, he’s also “gone vague.” With the exception of specific personnel moves, the overwhelming proportion of savings includes studies and promises to find cost savings, rather than actual cost savings.

The mayor’s proposals to increase retail sales and identify unused parcels of land assume that private developers are incapable of doing this themselves. At a recent hearing on the redevelopment of the old Health Care District near 9th Ave. & Colorado Blvd., the developers identified that parcel as one of the most desirable retail spaces in Colorado.

The mayor’s rejection of specific fees for libraries and trash collection may avoid taxpayer ire, but it’s hard to escape the feeling that the decision had more to do with avoiding the accountability imposed by earmarked revenues.

Genuinely bold proposals would include privatizing or outsourcing such city services as vehicle fleet maintenance, building and road maintenance, and park maintenance and rec centers.

Big city Democrat mayors have championed similar moves across the country, including Rahm Emanual in Chicago, Antonio Villaraigosa in Los Angeles and Alvin Brown in Jacksonville. Newark Mayor Cory Booker has been at the helm of an astonishing and ongoing turnaround of that troubled city. Facing a fiscal crisis during his first term, Mayor Hickenlooper made ends meet without resorting to tax increases. One reason he became governor was his understanding that Colorado has “no appetite” for tax increases.

In California, where cities like Stockton and San Bernardino have declared bankruptcy due in part to crushing public pension obligations, voters in San Diego and San Jose voted overwhelmingly to significantly reform public employee pension and health plans.

Earlier this year Newark’s Mayor Booker was the featured speaker at the Colorado Democrats’ Jefferson-Jackson Day Dinner. While he spoke largely about his personal story, he no doubt talked city business with Mayor Hancock privately during his visit.

Unfortunately for the citizens of Denver, Mayor Hancock’s proposed permanent property tax increase for the November ballot shows that he wasn’t listening.

Denver voters should recognize this proposal for the lost opportunity that it is, and instruct their leaders to try again.

Capitals and Embassies

Posted by Joshua Sharf in 2012 Presidential Race, Israel, National Politics, PPC on August 2nd, 2012

This evening, the Romney campaign hosted a conference call for Jewish supporters, with the featured speaker being Dan Senor, author of “Startup Nation,” about Israel’s economy. Senor accompanied Gov. Romney on his recent foreign trip, and spoke about some of the highlights.

During the Q&A, I asked him specifically about his recognizing Jerusalem as Israel’s capital, and moving the embassy there from Tel Aviv. A 1995 law provides for that, but also allows the President to waive that action for 6 months. Presidents Clinton, George W. Bush, and Obama have all repeatedly put off moving the embassy to Jerusalem. President Obama recently took this equivocation to new heights, when his spokesman refused to identify Israel’s capital:

The followed the BBC’s failure to identify any city as Israel’s capital on its Olympics site, while readily identifying Jerusalem as the capital of the as-yet non-existent country of Palestine. While the Obama administration is hardly responsible for the BBC, its failure to support Israel generally – beyond the security cooperation – no doubt contributes to an atmosphere where the Beeb can perpetrate such insults.

While I don’t think anyone can reasonably question Romney’s affection for and support for Israel, Obama’s supporters have taken to pointing out that President Bush, while also identifying Israel’s capital as Jerusalem, repeated waived moving the embassy.

Senor, I think, aptly separated the two issues. Moving the embassy isn’t necessary to recognizing a country’s capital. Likewise, it should be a no-brainer to recognize that Israel’s national governmental institutions reside in a part of Jerusalem whose position as a part of Israel has never seriously been questioned. Doing that in no way pre-judges the final status negotiations, which may take place sometime in our lifetimes.

In other words, doing so should have no immediate practical implications vis-a-vis the Palestinians, except insofar as they and other Arabs choose to be rejectionist of even minimal Israeli demands. It would, however, be of significant symbolic importance, making it clear that the US supports Israel as a normal country within the nation state system.

That the Obama administration is incapable of even that tells you all you need to know about the difference between Romney and Obama on this matter.

Olympian Taxes

Posted by Joshua Sharf in PPC, Taxes on August 1st, 2012

On this (imaginary) episode of Pawn Stars:

Customer outside of store: My name’s Michael, and I’m here at the Pawn Shop to sell my Olympic bronze medal. I’m hoping to get enough to pay the back taxes on the 15 gold medals that I won, and maybe have a little left over to have some fun at the tables before I go home.

Rick (to camera, in warehouse): I’m really excited to see this come in here. Olympic medals don’t just walk into the store all the time. I mean, this is a piece of history, and Olympic memorabilia is highly collectible. But I don’t care how good it’ll look sitting in my store, it has to be for the right price.

Rick (back at counter, to Michael): The US is one of the only countries to assess a prize tax on its athletes who win Olympic medals. Sen. Marco Rubio of Florida is supposedly introducing a bill that’ll change that, but right now, winners have to pay about $9000 per medal. Although there’s no truth to the rumor that the tax was instituted because it was a windfall, since, “they didn’t really win” the medals.

Chumlee: Yeah, isn’t that the real reason that the ’72 US basketball team didn’t pick up their silver medals? They’re all amateurs, and they couldn’t afford the taxes.

Rick: Shut up, Chum.

About That Battleground States Poll

Posted by Joshua Sharf in 2012 Presidential Race, Media Bias, PPC, President 2012 on August 1st, 2012

The MSM is making much of this morning’s Quinnipiac/NY Times/CBS poll allegedly showing President Obama moving ahead in the battleground states of Ohio, Pennsylvania, and Florida. This poll should carry more weight, since it is a poll of likely voters, probably identified by whether or not they voted last time, and whether or not they voted in the primary. But as is often the case with MSM polls, the internals belie the conclusions.

The poll shows President Obama leading Governor Romney 50-44 in Ohio, 53-42 in Pennsylvania, and 51-45 in Florida.

Obama actually won these states 51-47, 54-44, and 51-48, respectively. That in itself should raise some suspicion. I don’t know of any other significant polls that show Obama running ahead of where he did in 2008. Nationally, he won by 7 points, and Rasmussen’s daily likely-voter poll has shown only occasional movement from a 47-44 Romney advantage. I suppose it’s possible that concentrated saturation-bombing could move polls in individual states, but I’ve seen such tactical strategies in the past, and they almost always come from losing campaigns.

The other odd number is how people claim to have voted in 2008. These are, respectively, 53-38, 54-40, and 53-40, or +11, +4, and +10 vs. how those states actually went. Even assuming people moved around, the numbers for Ohio and Florida are huge, and the number for Pennsylvania is still significant. While people are more likely to remember themselves as having voted either for a winner, or for their current preference, even if they voted the other way, it’s hard to believe these are representative of the people likely to vote in this election.

Lord knows, I’ve been wrong about polls before. Tomorrow morning at Denver’s First Thursday Breakfast, pollster Floyd Ciruli – a Democrat, but you’d never know his party affiliation from his commentaries – will be speaking. I’ll ask him about these conjectures then, and report what he has to say.