Archive for July, 2011

Gov. Pawlenty Speaks

Posted by Joshua Sharf in Uncategorized on July 29th, 2011

I had the chance to go to a Meet and Greet with Gov. Tim Pawlenty across the river in Council Bluffs this morning. The setting was a nice little cafe, the Main Street Cafe, surprisingly enough, on Main Street. I won’t dwell on my first experience with Iowa retail politics, except to say that everything you’ve heard about it is true.

Pawlenty spoke well, but not outstandingly, in my opinion. He gave solid, conservative answers to the questions asked, and while some of the social issues did come up, the primary focus was on national defense, the budget, and economic issues. I thought his answers to the budget/debt questions were a little weak; he didn’t seem to grasp, for instance, that Boehner 2.0 incorporated many of the elements of Cut, Cap, and Balance, in another form.

The sound, I will warn you, is not that great. Pawlenty is near the tail end of qualifying for residency in Iowa, and his voice was a little weak, and trying to compete with a loud air conditioner in a small room.

| Stump Speech | |

| QA – Boehner Plan 2.0 | |

| QA – Family Leader | |

| QA – Federal Overreach | |

| QA – Congress and Public Employees Benefits | |

| QA – Military | |

| QA – Payment Priorities | |

| QA – RomneyCare | |

| QA – Taxes | |

| QA – UN and International Law | |

| Closing |

Podcast: Play in new window | Download

One More Thought on the BBA

Posted by Joshua Sharf in PPC, President 2012 on July 29th, 2011

There are a couple of ways that, skillfully used, the BBA could actually end up helping the Republicans, at least in this first round.

First, it’s a bargaining chip. If the owners can give up an 18-game season that the players were never going to play, the Republicans may be willing to settle for a BBA vote (as opposed to passage), forcing the Dems to re-assert their Big Government bona fides.

More interestingly, if Boehner 2.1 (Boehner 2.0 with the BBA upgrade) passes the House with Democrat support, as seems likely, it’s going to make it harder for them to go back on that when it actually comes time to vote on the BBA. And if it gets stripped out in the Senate, you may end up with the spectacle of House Dems, having vote against 2.0, and then for 2.1, having to turn around and vote for 2.0 when it comes back around.

Regardless, the Republicans need to hold firm on the smaller cap increase number. The benefit of having this debate again – and possibly yet again – before the election, both political and policy-wise, are too integral to the overall strategy to roll over on.

Debt Markets React to Washington – Finally

Posted by Joshua Sharf in Business, PPC, President 2012 on July 29th, 2011

People have noted the failure to demand higher yields for treasuries, and concluded that the debt markets don’t believe there’s any problem with August 2, or 10, or any other date we care to mention. In fact, this was largely out of disbelief that Washington could fail to act.

In fact, this week, the debt markets have begun to react. Banks are beginning to pull money out of treasury-heavy money market funds, which in turn are selling treasuries and putting their money in banks. This has the effect of reducing the financial flexibility of each. The repo market – where financial institutions lend securities money to one another, using treasuries as collateral – is beginning to demand higher interest rates. Companies that don’t even like debt are issuing short-term commercial paper to make sure they have cash on hand. Let’s not turn this into panic – it’s not. But the markets are beginning to take prudent and overdue steps to protect themselves against a loss of liquidity in treasuries, even if it doesn’t mean technical default.

In the meantime, it appears that Speaker Boehner has agreed to a stricter Balanced Budget Amendment requirement for the 2nd round of cuts & debt limit increases – requiring passage rather than just a vote. I think this is a mistake.

There is every indication that Boehner Plan 2.0 was pretty close to the plan that he and Harry Reid presented to the President on Sunday, and which he indicated he would veto. But a close reading of the tea leaves also indicates that he was hoping that a strong enough statement against it would prevent him from actually having to make that decision. If he had signed it, it would have strengthened the conservative case for governance immensely.

Now, the House has probably made it more likely that they will end up voting on – and probably passing – some compromise between McConnell and Reid. That deal would, in fact, work towards marginalizing the Tea Party groups who have done so much to get us to this point.

I hope I’m wrong, and that the wording of the BBA is something that can get passed – it requires no presidential signature – and that the extra time we’re buying is put to good use making the case for it. Certainly Obama & the Democrats’ desire to run the federal budget on auto-pilot helps in that regard.

But if not, and if the 30 or so Republicans end up setting the stage for an exact repeat of this in 6 months, with no BBA in hand, they may well end up moving the debate to the left, rather than to the right.

One other point – I do think reasoned analyses such as McArdle’s, which show what will likely happen if we don’t raise the ceiling, without the histrionics, actually help our case down the road. If the markets do shudder a little bit, it should server as a spectre of what will actually happen, for real, when the debt markets finally decide to take that decision out of Washington’s hands altogether.

UPDATE: The Dollar-denominated Swiss Franc ETF, FXF, opened almost 2% higher this morning, and stayed there the whole day. I went back and looked, and since 2006, the daily percentage change has been bigger than this – in this direction – only 10 days, so this is definitely a multi-sigma event. One guess as to why it happened.

The Most Popular Man In Town

Posted by Joshua Sharf in PPC, President 2012 on July 28th, 2011

Is usually the backup quarterback. Right now, Rick Perry is polling extremely well. He’s played this skillfully so far, not letting himself be rushed, getting people to ask him to enter, and them building up a fundraising effort and making all the right contacts. (Personally, I like what I see so far; he’s turned what was a weak office into a strong one, and made Texas – Gen. Kearney notwithstanding – into where Galt’s Gulch would be located if Rand were writing today. This stops well short of an endorsement, I’d just like to see him have a chance to make his case.)

That said, we really don’t know how he’ll do on the big stage of a presidential race, or much about his governing style yet. He’s the backup quarterback, whose popularity largely reflects discontent with the starters. Time will tell if he’s Tom Brady or Bubby Brister,.

Obama’s Evergreen Goes Brown

Posted by Joshua Sharf in 2012 Presidential Race, Business, Economics, Finance, National Politics, PPC on July 28th, 2011

Barack Obama and Harry Reid may not be able to produce a spending plan, but at least they have their old campaign talking points from 2008 to fall back on.

With the Senate having failed to produce a budget in over 2 years, the President’s budget having succeeded in uniting Washington to a degree not seen since it was under threat of attack 150 years ago, and neither willing to commit a spending plan to paper, they can be relied on to Blame Bush!

The White House has put out a graphic purporting to show that – surprise! – 8 years under President Bush added more to the national debt than 2 years under President Obama. (They play with the numbers, by assuming that the cut in marginal tax rates didn’t stimulate growth, for instance.) That President Bush wasn’t exactly a fiscal conservative like FDR isn’t a secret to anyone. In its day, what was seen as recklessness spawned Porkbusters, the Tea Party in embryo.

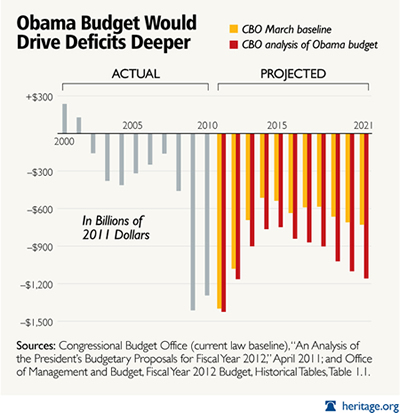

But let me remind you of this chart, originally in the Washington Post:

It’s been updated by the Heritage Foundation:

Much as Babe Ruth redefined baseball by showing what could be done when you try to hit home runs, so has Obama redefined deficit spending by showing what happens when you really put your heart and soul into it. You’ll notice, by the way, that the latter graph compares the CBO to itself, rather than to the White House budget, because, haha, there isn’t a White House budget.

Note also how the color bars in each graph look the same, only they’re shifted to the right by two years in the update. It’s evident that 2010 and 2011 haven’t worked out as planned. It’s no wonder that Tea Partiers don’t really believe in out-year cuts; the deficit reduction hasn’t occurred because Obama’s policies and those of Congressional Democrats have stifled economic growth, and because they’ve been happy to govern illegally, without a budget for two years, leaving federal spending essentially on auto-pilot.

The other argument you hear is that Paul Ryan’s budget made use of the same accounting trick that Harry Reid’s budget-avoidance bill does: counting savings from the Iraq and Afghanistan wars we won’t be fighting. But Ryan’s plan was an actual budget. There were always holes, but the difference between “will spend” and “would have spent” means a lot less when you’re drafting an actual plan, than the difference between “will spend” and “will take in.” Ryan applied that $1,000,000,000,000 to a headline.

Reid proposes to let the President spend it between now and Election Day 2012.

The Democrats won’t produce a budget because they can’t, only they don’t want you to know that until after the election. So much for them.

The Tea Party folks have a different complaint, namely that Boehner’s Plan doesn’t go far enough. I’d like to see more cuts, too. But the idea, as I recall, was to use the debt ceiling deadline as a means for forcing a debate, forcing changes to the spending that is current and planned. It was never realistic to run the entire federal government out of the House of Representatives.

To that extent, the plan has been wildly successful. It has exposed the Democrats as dangerously delusional about the state of our finances, whose only current idea is to soak you to ratify a massive increase in the scope of our economy directly controlled by the government. The Boehner Plan re-adjusts the baseline, keeps the debate on the front burner pretty much through the election, and does it without raising taxes. These are major victories, and they would not have been possible without the Tea Party. Period.

That said, this particular fight is one of many. Pushing too hard right now, bringing on a technical default, or, more likely, putting incredible discretionary power in the hands of a teenage president, won’t be Sherman marching through Georgia, it’ll be Napoleon marching to Moscow.

There is considerable frustration abroad that we can’t simply win this thing already. But politics isn’t about that. Regardless, we’ll have to keep watching, pushing, and prodding. There aren’t any final victories in politics, either over the other party or within your own. The best use of this battle is to pocket the gains, and use the process to help prepare the battlefield for the next fight.

Individuals Pay Corporate Taxes – Just Not Always The Consumer

Posted by Joshua Sharf in Business, Finance, PPC, Taxes on July 26th, 2011

Right now, our corporate tax structure makes no sense. It not only plays favorites, it drives many of the unfavored abroad. We have the highest corporate tax rate in the world, and the code is so riddled with exceptions, subsidies, and loopholes, disguised as “incentives,” that, as Megan McArdle put it, large companies basically have branch offices of the IRS on site to negotiate their tax bills.

So it makes sense that we should lower the corporate tax rate in exchange for cleaning the thing up.

It makes sense for all sorts of reasons, but not for one reason you often hear mentioned: that corporations just pass the increase along to consumers. They don’t. At least not always, because they can’t.

Who pays the tax is known as, “tax incidence,” and it depends on who has the fewest options. Economics recognizes something called, “elasticity.” Supply Elasticity is how much the supply changes depending on the price, and if you’ve been following along, you’ll know that Demand Elasticity is how much demand changes in response to price changes. Vacation rentals have a pretty high demand elasticity. Gasoline, on the other hand, has a fairly low demand elasticity: the price goes up, but you still have to get to work.

On the supply side, airline seats have a fairly low supply elasticity; once an airline has planes in inventory, they’re not likely to mothball them, at least not in the short run. Tobacco, on the other hand, has a pretty high supply elasticity: when the price falls, supply falls quickly to match.

(A word for the pedantic: elasticity is not constant. At very high or low price levels, we as consumers or producers may behave differently. You can only drive so much, even at $1 a gallon, lowering demand elasticity. Of course, at that price, there won’t be any refineries operating, either. Also, there’s the economist’s eternal escape hatch – the long-run and the short-run. It may be expensive for me to increase or limit supply, but give me enough time, and I’ll find a way.)

So what does this have to do with the tax on eggs in China?

If I’m the one with fewer choices, I’ll probably have to eat most of the tax. Suppose, for example, I make the Indispensible Widget. It’s easy for me to ramp up and ramp down production, but it’s a commodity you have to have, every day, all the time. This gives me, as a producer, pricing power, and it means that when our taxes get raised, we can pretty much – up to a point – pass that expense along to you. (Remember, even monopolies don’t have infinite pricing power, and even commodities producers have competition.) So in that case, yes, it’s the consumer who gets shafted.

Now, suppose I sell something else, something where the industry can’t readily reduce supply, but you have a lot a choice in whether or not buy. High-end vacation hotel rooms, for instance. I may be able to reduce some operating costs, but those costs are what make them luxury. And vacations are very price-sensitive. There may be some times when I can just tack on the tax, but if I’m trying to compete with your staycation, I probably won’t. My shareholders and employees will eat it.

Note that there’s a similar relationship at work with how shareholders and employees split their end of the deal, too. Labor, too, has supply and demand price elasticity. If your labor is a commodity, you may not get that raise this year, or may even get a pay cut or fired. If you have specialized skills, ownership may not be able to pass the tax along to you, either.

The point here is that while individuals always pay corporate taxes, those individuals may be consumers, employees, or owners, depending on the business. It’s not as simple as businesses just passing the cost on to their customers.

Why is this an argument for tax reform? Hayek’s Pretense of Knowledge. The government can’t really know, except in the coarsest way, what the tax incidence for the corporate income tax will be on a given industry. Subsidies may end up going to industries that don’t need them, or that can’t find a good place to invest them. They may reward employees, or not; they may help subsidize demand, or not. And what was true yesterday may well not be true tomorrow.

Ideally, we would simply ditch the corporate income tax altogether. Salaries and employment would rise, as would consumption, dividends, and investment, so the government would see a lot of that revenue come back immediately, and much more from growth.

But barring that, a flat rate, which instead of aiming for universal “fairness” accepts the fact that industries and businesses differ from one another, is the wisest course.

Thaddeus McCotter Declares

Posted by Joshua Sharf in PPC, President 2012 on July 4th, 2011

Thaddeus who? Thaddeus McCotter, a Republican congressman from Wayne County, Michigan, has declared his candidacy for the Presidency. He’s sharp, quick, and intelligent, and with a razor sharp and very dry wit. He has a keen sense of the threats facing the country today, and is unafraid to articulate them:

So I explain to my constituent, the person who employs me, and the person that I work for (applause), that the United States faces four great challenges: we face the social, political, and economic challenges of globalization, we face a world war against an evil enemy, we face the rise of the Communist Chinese superstate as a strategic threat and rival model of governance, and we face the question as to whether a nation built on self-evident truths can survive the erosion of those truths through moral relativism…

The Republican Party continues to have four goals: 1) we expand liberty and self-government, 2) we conserve our cherished institutions of faith, family, liberty, and country, 3) we empower the American people to achieve necessary constructive change, and 4) we defend America from her enemies and we support her allies.

In pursing these goals we have five fundamental principles: 1) Our liberty is from God, not the government, 2) our sovereignty is in our souls and hearts, not the soil or a scepter, 3) our security comes from strength, not surrender or appeasement, 4) our prosperity is from the private sector not the public sector, and 5) our truths are self-evident, not relative.

Where, you might ask, are the fiscal issues? McCotter has voted against the bailout, against raising taxes, against the “stimulus,” and in favor of the Ryan Budget Plan. He would probably answer, although I haven’t seen him do so, that addressing our fiscal crisis is something that a responsible government must do, but that it is not an external challenge. It is instead the result of long-running governmental malfeasance. Correcting it will put us in a better position to address our current challenges.

Some of you may know him from his appearances on Fox News’s Red Eye. It says a lot that he’s not only able to hold his own in such an unorthodox setting, but that he’s willing to put them on his official YouTube Channel. McCotter takes his politics seriously, but not himself, a rare characteristic in a politician:

McCotter will not win the nomination, but I’m glad to see him running. As with Michelle Bachmann, it’s, ah, open to question, as to whether a few terms in House is sufficient qualification to be President. But he’s an effective voice for traditional conservatism at a time when we desperately need such a voice.

He may also well be Ron Paul’s worst nightmare. Because we’ll finally have comic relief that’s both funny and substantive.

The Declaration – A Constitutional Document

Posted by Joshua Sharf in Uncategorized on July 4th, 2011

I’m writing this even as I’m grilling kabobs out on the barbie, so I probably haven’t adequately synthesized the couple of views presented here. And like any long an complex story, I’m skipping a lot in a few hundred words. But they’re worth thinking about, on this Independence Day, in a season of renewed interest and admiration for our founding.

Pauline Maier, in her reluctant study of the Declaration, American Scripture, notes that even adopting it was somewhat controversial. Was it even necessary? In fact, states and localities had been adopting “little” declarations for some time. Many of them were of similar form, and took the point of view that what they did was not declare independence as a new fact, so much as recognize an existing fact. Much of the debate in Congress over the necessity of the document was over the same question – if Congress was merely recognizing an existing fact, was it necessary or beneficial to make such a declaration.

Eventually, as we know, those in favor of the declaration won out. The necessity of a declaration, both for national unity and for clarity of purpose, was deemed overriding.

Maier, would agree that the Declaration is descended more from the English Declaration of Rights in 1689, than from Locke. In fact, Maier traces that descent explicitly. Jefferson, in his preamble to the Virginia Constitution, and George Mason, in the Virginia Declaration of Rights, both drew heavily from that document, and Jefferson used it as the source text for much of the preamble for the Declaration of Independence.

Russell Kirk would agree. In fact, he did agree, in his Rights and Duties, Our Conservative Constitution. The Declaration of 1689 was about what form the Constitution of England would take. It was about the relative powers of King and Parliament, and established once and for all that the King ruled with the consent of Parliament, consent that could, with sufficient provocation, be withdrawn.

Constitutions need not be written; Kirk, a dyed-in-the-wool conservative, notes that they’re just the basic rulebook we all agree to play by. It need not be written, and in the case of our own, it must be open to reasonable and limited interpretation if it is to be brief enough to belong to us all.

Kirk notes that when the Constitution was written, not Locke but Burke was uppermost on the minds of the the Framers, and that the same was true in 1776. The Founders, whose colonies had been founded by Royal Charter, considered themselves subjects of the King, not Parliament. They sought the protection of the King against Parliament’s rule, rule which it had asserted in “all cases whatsoever.” Good luck getting that from a King who knew all too clearly what side his crumpet was buttered on.

Whence, then, that Lockean bit about rights of man? Kirk argues that it was largely pragmatic. The Congress was made up of practical politicians who held certain ideas in common. Pragmatically, they wanted to appeal to the French, and so tossed them a bone in order to appeal to their current political-philosophical fashion. That doesn’t mean they didn’t believe it, but it does mean that that portion, no less than the bill of particulars against George III, was an attempt to show decent respect to the opinions of mankind.

In Kirk’s view, the Revolution was not about Lockean rights, although the Founders understood those. It wasn’t even really about taxation without representation; they weren’t interested in representation in a Parliament where such representation would mean submission to its will, “in all cases whatsoever.” It was about what form the English Constitution would take, and whether or not their own self-government could find a place in it. When they determined, finally, that their own self-government had no place in the English Constitution, they declared that they were, indeed had been, independent, and were now declaring that as a fact for the world to see.

It is that right – the right of self-government as free born citizens, that the Declaration declares, that the Constitution protects, and that we celebrate today.