UPDATE: And as if on cue, this morning, JJG, Barclays ETF on grains, is up almost 5% this morning. This is not just a generalized inflation play (meaning this isn’t just about the Fed printing dollars), since GLD and TBT (the bearish bet on the 10-year Treasury) are up, but only about 1%.

Much has been said about the contradictions between the energy policy that President Obama announced today, and how his government has behaved up until this point. But even taken on its own terms, today’s ethanol-and-natural-gas announcement contains enough internal contradictions to make it fall over like a basketball player with his shoes tied together.

The key point here is that ethanol already depends heavily on natural gas. Twice. Directly, as an ingredient in its production. But ethanol is made from corn, and corn – especially when planted in the same fields, year after year – requires a lot of fertilizer. And the key component in ammonia-based fertilizers like anhydrous ammonia, urea, and ammonium nitrate in nitrogen. From natural gas.

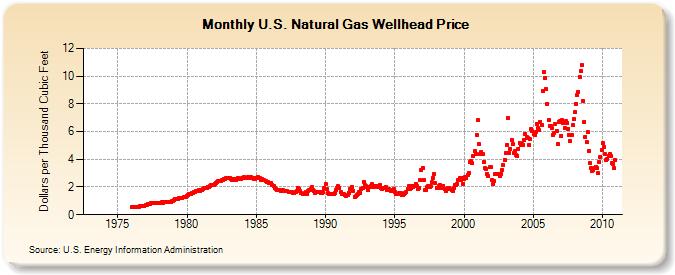

When I worked at the brokerage, one of the companies we covered was a fertilizer company (since bought out), based in the heart of the corn belt. We considered it an ethanol play, with the company remaining profitable as long as corn plantings increased and natural gas didn’t get too expensive. Again. Here’s the chart for the wellhead price of US natural gas:

In 2007, during the last burst, corn planting came at the expense of soybeans, which returns nitrogen to the soil. This meant a large increase in the amount of fertilizer necessary. For the last few years, soybean planting has returned to its long-term trendline, and increased corn production appears to have occurred at the expense of winter wheat, which uses a comparable amount of fertilizer:

Up until now, that’s meant that increased corn plantings, inadequate though they may be, haven’t in and of themselves driven up the price of natural gas. This year, however, soybean plantings may be down, as corn nears its postwar high, meaning additional natural gas demand.

All of this is happening even without Obama’s intervention to commandeer even more of our food for fuel. We already push 1/3 (yes, one third) of our corn harvest into ethanol plants rather than kitchen tables, which amounts to about 8% of the world supply of corn. Any additional ethanol subsidies will only make things worse.

Moreover, Obama’s plan does absolutely nothing to increase natural gas production. To do that, he seems satisfied to ride herd on oil and gas companies that already have more than enough incentive to increase production, if only our government would let them. (Sadly, Colorado, between Ken Salazar and Diana DeGette, is playing a disproportionate role in enforcing that dictate.) He does, however, propose all sorts of subsidies to encourage increased natural gas consumption, promising to drive the price up even farther.

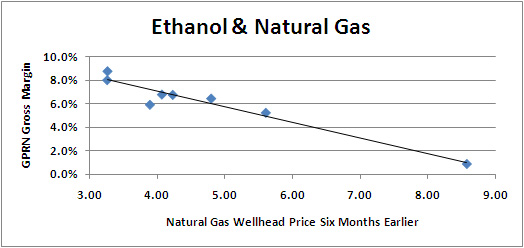

To circle back to my original point, this is going to make ethanol unprofitable even with subsidies. Just for fun, I went back and looked at the gross profit margin for Green Plains (GPRE), a major ethanol producer, and compared it to the natural gas price six months earlier, for the last 8 quarters:

The correlation is an astounding -0.96, which is about as close to metaphysical certainty as you get in statistical analysis. Those who know something about statistics will say that the outlier increases the correlation, and they would be right. If we get rid of the outlier, the correlation is still -0.84, and the slope of the line only changes slightly. If the other points, the ones below 6.00 on the price scale, were clustered together, that would be a problem. But they lie on a nice line of their own.

Using a very rough model, using the company projections for unit sales over the next year, assuming that interest rates don’t rise and the company doesn’t take on any additional debt, the wellhead price of NG would have to rise to 6.8 to eliminate the company’s pre-tax earnings completely for the next year. That’s happened twice over last decade, and this administration’s policies will only make it more likely. Let that happen, or interest rates rise, or both, and see how fast Green Plains decides that it really does need those subsidies – and more – after all.

To the extent that ethanol production can increase, it will help drive up natural gas prices. To the extent that it can’t, its price will rise, and it will need compete for ever-more-scarce natural gas.

Even if ethanol weren’t already a colossal waste of money and resources, this plan couldn’t be designed any better to make things worse.

In this at least, Obama’s being consistent with the rest of his economic policies.