Archive for category Finance

Transparency At A Steep Price

Posted by Joshua Sharf in Colorado Politics, Finance, Taxes on October 22nd, 2013

This post originally appeared on Watchdog Wire Colorado (“Gov. Hickenlooper Channels His Inner Pelosi“).

Rep. Nancy Pelosi (D-CA) famously said about Obamacare that, “We have to pass the bill so that you can find out what’s in it, away from the fog of the controversy.” That seems to be the line that Gov. John Hickenlooper (D) is taking with respect to PERA spending by the state’s school districts, and Amendment 66.

In a recent post that has garnered attention from both the Colorado Springs Gazette and the Denver Post, we discussed the governor’s approach to PERA spending by the districts, which is to increase transparency in order to drive public opinion:

Gov. Hickenlooper: Well, if you want to fix that, if that’s what’s happening, then we can’t legislate that. There’s a certain amount of money that goes into the districts, and that is the way our education system is structured. If you want to fix that, put it up on our website, how much of that money the district is spending on PERA. And I guarantee you the parents will go nuts.

In response to another question at that same October 8 event, Hickenlooper touted the transparency website as part of the “Grand Bargain” of Amendment 66, that the entrenched interests and monopoly power of the districts and the teachers unions would likely not have accepted the transparency without the additional money from Amendment 66’s tax increase:

And the other question of whether you could just do this – let’s assume the website was for free, to get that into the bill, the school districts, and the school administrators, would have fought it like crazy, because it’s going to make their life hell.

The only reason they were willing to let it be in this bill was because we had a tax increase.

It’s why they call it, “The Grand Bargain.” We’ve got all this stuff that no other state – I mean – doesn’t it sound like a great idea to have that transparency? And yet why is it that not a single other state has that kind of a website. (Emphasis Added.)

In short, he’s arguing that the only way to get the transparency is to vote for the tax increase first.

However, the legislature has in the past mandated transparency, and with no objection from the districts. In 2010, the legislature approved HB10-1036, the Public School Financial Transparency Act, virtually without objection. Among other things, it’s the reason that school districts have to post Comprehensive Annual Financial Reports and Quarterly Financial Statements online, along with check registers and credit and debit card purchase statements within 60 days of incurring the expense.

The bill passed without dissent through both Education Committees, and registered only one “No” vote on the floor of the House. It appears as though nobody testified against it in committee. Our own Ben DeGrow did testify in favor of it before the House Education Committee.

If the governor is now arguing that such an extension of the transparency requirements would meet with stiff resistance from the school boards and teachers unions, he’s essentially arguing that there’s not enough support within the majority Democratic caucus in the legislature to get such a bill passed, and admitting perhaps more than he would like about union influence within that caucus.

In order to garner support for the tax increase from reluctant parties, Gov. Hickenlooper has pledged to put SB10-191’s tenure reform on the ballot in the form of a Constitutional amendment, should the expected legal challenges succeed. If the tax increase amounts to the price to be paid for bringing his own caucus along on transparency, it calls into question his ability to fulfill that pledge once the tax increase has already passed.

Is Legislative Stinginess to Blame for PERA’s Problems?

Posted by Joshua Sharf in Finance, PERA, PPC on January 28th, 2013

One of the favorite tropes of PERA apologists runs like this: PERA was fully-funded in 2001 or so, at which point the state legislature began failing to make 100% of its Annual Required Contribution (ARC). It was then that PERA’s funded level began to drop off. Therefore, if the state legislature had fully-funded the ARCs, today, PERA would not face a massive unfunded liability.

It’s a rhetorical masterstroke, redirecting blame for the current situation on a stingy state legislature that put PERA last in its priorities. And while grounded in a grain of truth, it severely understates and misattributes the nature of PERA’s financial crisis-in-the-making.

The grain of truth is this: the state legislature, beginning in 2003, began to under-pay its Annual Required Contribution. Of course, this affects not only the immediate year, but all future years going forward. Not only is the money from the shortfall not there, but the accumulated return on those dollars aren’t there, either. For this post, I’m just going to focus on the two largest divisions, the School Division and the State Division. They were combined in 1997, and separated again in 2006, so I’ll consider them as a unit.

Here are the yearly shortfalls, along with their future values to the end of 2011 (the latest year for which we have data). The first year for each underpayment is dollar-cost-averaged, so we give half the year’s return, and full yearly returns thereafter:

For 2003, the legislature underpaid by about $177 million, costing about $142 million in future returns, for a total effect in 2011 of $319 million. If you add up the total effect, year-by-year, you get the following result:

So by the end of 2011, the cumulative effect of 9 years’ worth of funding shortfalls is a little over $4 billion. The argument by PERA hinges on the fact that it’s at 2003 that PERA began to be underfunded:

As you can see, though, PERA was already suffering from poor 2001 and 2002 returns, even though there was no shortfall from the state those years. What did increase substantially was the size of the liability; the size of the assets actually held steady. From 2004 to 2007, solid returns managed to keep the dollar amount of the gap from growing. But then 2008 hit, and the size of the obligations continued to increase even as the fund got clobbered in the market. The liability dropped as a result of certain stop-gap changes that were made in 2009, but has since resumed its upward march, even as the actuarial value of the divisions’ assets has continued to fall.

Would it have made a difference if the state had made good on its entire ARC for 2003-2011. The answer is yes, but not very much. Adding in the cumulative shortfall each year, here’s the effect on the assets and the funded ratio for the State and School Divisions:

Despite some increased, they’re still seriously underfunded. Since it’s difficult to see the difference between the two charts, I’ve made the comparisons here. First, the difference in assets:

An increase of total assets from $31 billion to $35 billion is not nothing, as they say down at the station, but it’s also not nearly enough to start to close the gap with liabilities. So little that the difference in funding ratio barely moves the needle:

For those of you who want it all on one chart, possibly for optical exams, here it is:

In reality, it’s worse than this. Prior to 2006, PERA didn’t report a sensitivity analysis on its assumed rate of return, so we have only the values for 8%. If we assume a more realistic 6.5% return going forward the unfunded liability grows from $25 billion to about $40 billion, and the extra $4 billion makes even less of a dent.

PERA isn’t suffering from a legislature that isn’t keeping its promises, it’s suffering from having made promises it can’t keep. And it’s the very PERA members who are going to get hurt the most, the ones who’ve been sold a bill of goods about what’s waiting for them when they retire.

Your New Finance Committee Chairman

Posted by Joshua Sharf in Colorado Politics, Finance, PPC on November 28th, 2012

With the Democrats retaking the State House of Representatives, the time has come for them to name new committees, and new committee chairmen and vice chairmen. Most of the designees make sense, at least from an expertise point of view. While I may disagree vehemently with Max Tyler on energy issues, his district includes NREL, and he’s made a point of being vocal on things like wind and solar subsidies.

However, I draw the line at the appointment of Lois Court, my own State Representative, to be the Chairman of the House Finance Committee. Court has spent most of her time agitating for the elimination of the Electoral College, opposing Voter ID, and trying to limit citizens’ petition rights. So State, Veterans, and Military Affairs, where she’s served for four years as a member, would seem to be a natural fit for her interests. (Full disclosure: I ran against Mrs. Court in 2008 and 2010 for the House seat.)

Instead, incoming Speaker Mark Ferrandino appointed a state rep whose main contribution to finance discussions has been to sue her own constituents, to seek the repeal of the Taxpayers’ Bill of Rights. She has historically found its spending and taxation limits to be antithetical to the idea of representative government. (Most of us see her opposition as a threat to the state’s solvency.) With the governor’s TBD Initiative coming up this year, it may signal an intention on the part of the Dems to wage war on TABOR more openly.

And then, there’s Representative Court’s fluency with arithmetic:

and

Hint: Carry the two. Three hundred twenty-five.

Ladies and Gentlemen, your new Finance Committee Chairman. The state’s in the very best of hands.

COPs, Cash Flows, and Taxes

Posted by Joshua Sharf in Colorado Politics, Finance, PPC, Taxes on November 28th, 2012

We’ve pointed out some of the abuses of Certificates of Participation by the Denver and Jefferson County School Districts. However, there are times when COPs are good. One good use of COPs is as a cash management tool. Municipal bonds are usually non-taxable, which means their yields are lower than Treasuries of an equal term, especially in longer-terms, say, 10 years and over. Since a municipality doesn’t pay income tax, it can lend at the higher Treasury rate, while borrowing at the lower municipal rate, assuming that its credit rating is good. (I don’t care if Illinois has 30 years of gold stashed away, I’m not lending them a dollar for a hamburger to tide them over until next Tuesday.) The municipality can make a little reliable money on the arbitrage.

In essence, this is a tax-shift. The Treasury isn’t collecting income taxes that bond holders would normally pay, so that tax money is, in effect, shifted to the municipality. It’s the reason that Treasury yields are higher in the first place.

Over the last couple of years, though, this hasn’t really been possible. Municipal rates have stayed pretty steady, while long-term Treasuries have dropped precipitously as a result of all the various Quantitative Easings by the Fed. This has deprived municipalities of a source of cash. So while the stimulus was essentially a massive shift of debt from the states and municipalities to the Federal government, the feds are taking it back, inch by inch, by taking away this tax shift that had been available to the lower levels of government.

I don’t think it’s coincidence that one of the tax loopholes being mentioned for closure is the municipal bond interest. The feds would like to make this tax shift permanent by pushing up municipal yields above Treasuries. Most of the focus has been on the fact that this would make borrowing more difficult and expensive for municipalities. But it would also close off this tax shift as well. Both these facts will have the effect of making states and municipalities more dependent on federal funds.

Investing in School…Bonds

Posted by Joshua Sharf in Colorado Politics, Education, Finance, PPC on August 16th, 2012

I’ve written before about the proposed Jefferson County Schools mill levy increase, issues 3A and 3B, which will be on the ballot this fall. The committee supporting the measure is named Citizens for JeffCo Schools (sic), and according to EdNews Colorado (confirmed by TRACER documents), it has raised a little under $50,000 this year. Twenty thousand of that comes from Robert W. Baird, an investment bank based in Wisconsin. Another $15,000 has come from FirstBank, meaning that the remainder of small contributions – under $15,000 – is less than the $15K from FirstBank.

Robert Baird, as it turns out, is the district’s investment banker, confirmed in the minutes of the June 14 School Board meeting (available here). This means that should the bond pass, Baird stands to make a fair amount of money underwriting the refi.

This cycling of money by investment banks back into bond referenda that they stand to benefit materially from is extremely distasteful, and has gotten attention before.

Someone should ask the 3A/3B proponents about this.

UPDATE: Go to JeffCo Students First Action to see what you can do to stop this measure.

How Does PERA Rate?

Posted by Joshua Sharf in Budget, Colorado Politics, Finance, PERA, PPC on August 15th, 2012

Not well. According to its latest Comprehensive Annual Financial Report, PERA has an unfunded liability of $25 billion, up from $15 billion last year, mostly because of a dismal rate of return in 2011, roughly 1.9%. Much of the criticism of public pensions has centered on their unrealistic expected rates of return, 8% in PERA’s case. This is certainly a cause of concern. While 8% is not unrealistic for equities historically, most people consider it to be wildly optimistic, certainly for the near future. And in any case, a constant rate of return doesn’t take into account the volatility of those returns.

But there’s a second rate, the discount rate, which PERA also has to estimate. It signifies something else altogether, and like the discount rate, PERA’s assumptions regarding the discount rate serve to make the fund look more solvent than it actually is.

What is a discount rate?

Another term for the discount rate is the “required rate of return,” not by the plan, but by the investors in the plan. In some sense, you can think of it as the Rate of Return in reverse.

The Rate of Return is used to estimate how much today’s investment will be worth tomorrow. PERA assumes an 8% rate of return, and for the moment, let’s humor them. This means that $1,000 today will be worth almost exactly $10,000 in 30 years.

The discount rate works in reverse. If I know that I’m going to need $10,000 in 30 years, then I can run that number in reverse, discounting by 8% each year, until I see that I need $1,000 in the bank today to be able to meet that obligation.

PERA, like most government pensions, uses the assumed Rate of Return as the Discount Rate. If you have $1,000 in the bank, after all, you have enough to cover a $10,000 obligation.

Why not?

Because in this case, the discount rate is supposed to discount back obligations, not assets. It is suppose to represent the required Rate of Return of the investors, in this case, the pensioners. And since the pensioners’ assets (their PERA benefit) is the same as PERA’s obligations, PERA should use the Rate of Return that pensioners should expect on their investment.

What rate is that? Basic economics says that risk needs to match return. The market should price assets with the same risk at the same Rate of Return. Otherwise, for two assets with the same risk, an investor could sell the one at the lower rate of return, and buy at the higher rate, and not have any risk at all. Obviously that’s not sustainable.

So the trick is to find an investment with roughly the same risk as PERA, and use its return as PERA’s discount rate. PERA is a contractual obligation by the state, much like a long-term bond. It can probably change the terms of PERA more easily than it could default on a long-term bond, but again, let’s assume that these are pretty close to having the same level of contractual obligation, and therefore, from the investors’ point of view, the same risk.

This is what private pensions have to do. A corporate pension would use, as its discount rate, a mix of high-quality corporate debt, because that’s market-traded debt at the same level of obligation as its pension obligation. It’s only by the grace of the Government Accounting Standards Board (GASB), that PERA and other public pensions can get away with the higher discount rate.

Right now, according to MunicipalBonds.com, Colorado has long-term revenue bonds trading between 4,5% and 5%. Conveniently, if we use 4.75%, a $10,000 obligation translates to $2500 today.

So What Does This Mean?

Well, in our example, it shows how the level of fundedness is dependent on the choice of discount rate regardless of whether or not the 8% Rate of Return is realistic. If PERA has $1,000 in stocks, and chooses a discount rate of 8%, it looks as though it’s fully-funded. But if PERA is forced by accounting standards to choose the (more correct) discount rate of 4.75%, it’s underfunded by $1500, and is only 40% funded – even if we can realistically expect 8%.

That’s because the two rates really don’t have anything to do with each other. One is the rate of return PERA expects on its assets from its own investments. The other is the rate of return that pensioners expect on their investment. What PERA invests its money in is a policy decision. It may be good or bad policy, but pensioners expect to be paid, just the same as bondholders do, and that’s what determines the riskiness of the pension as an investment, not whether or not management puts it in gold bars or decides to go to Vegas and put it all on Red.

Ideally, PERA would match its return to its obligations. It would invest at something that also returned 4.75%, and have $2500 in the bank to be able to cover the $10,000 obligation, 30 years from now.

When it’s allowed to select a higher discount rate, though, it can get away with looking fully-funded with a much less money. Obviously, it has every incentive to do that. To do that, it has to seek investments with higher expected return. But in chasing higher returns, it’s also taking on additional risk.

Not only does the higher discount rate make PERA look more solvent than it is. It also encourages it to make riskier investments with its pensioner’s money.

Amortize This!

Posted by Joshua Sharf in Education, Finance, PERA, PPC on July 6th, 2012

In Pension accounting, the amortization period is how long it would take to pay off the current unfunded liability, based on current contributions, and current employees.

Typically, pensions try to keep that time at about 30 years, or a normal, long career. That does a pretty good job of matching contributions to liabilities.

The amortization period for PERA’s school fund is now 59 years.

PERA’s retirement age is 58.

Retirees who haven’t even been born yet are having their benefits amortized by current contributions.

Sleep well.

Chronicles of Crony Capitalism

Posted by Joshua Sharf in Business, Finance, PPC, President 2012, Regulation on February 23rd, 2012

So far, the LightSquared story has mostly been written as one of the FCC favoring a politically-connected company at the expense of its competition, and that favoritism having resulted in nothing but waste. See, for example, today’s Coffee and Markets podcast on the subject. Their related links (Documents: LightSquared shaping up as the FCC’s Solyndra and Documents show Obama’s FCC used regulatory muscle to destroy LightSquared’s competition) pretty much give the outline. It’s a simple story, and one that fits in neatly with an overarching narrative, as they like to say, of political money buying regulatory help.

As usual, the story is more complicated than that. And as usual, the full story makes things look even worse.

The Wall Street Journal ran a story discussing just how badly the FCC had tied itself up in knots over this. First, they declared a looming bandwidth shortage, and then quickly auctioned off additional spectrum, spectrum that happened to lie near to that used for GPS. This was done years ago, and Falcone and his people no doubt assumed that the FCC wouldn’t be selling spectrum that couldn’t be developed. Having gotten the favor, they then were surprised when the FCC didn’t turn around and tell the GPS people that this was coming, and that they should shield their equipment – technically well within their capability. Having failed to do that, they now have to argue that there’s no spectrum shortage, after all.

Even assuming that the FCC wasn’t out to clear the field for LightSquared, they failed badly in their regulatory duty here. The FCC has complete control over this stuff. They can decide how, where, and when spectrum gets exploited, and by whom. Either there is or isn’t, was or wasn’t, a spectrum shortage that will imperil future growth. Either the spectrum neighboring the GPS wavelengths is or isn’t usable. Either the burden of preventing interference lies with LightSquared (or whoever buys this tainted real estate from them), or it lies with the GPS companies.

Either the FCC didn’t know how it was planning to resolve this issues, or didn’t care. Or else, it knuckled under to a multi-million dollar lobbying campaign, in which case, what’s the point of claiming “independent” regulatory agencies are any good at all? If the FCC was throwing around its weight to help LightSquared, all these regulatory conflicts become even worse, leading other investors to throw their money after an investment the FCC must have known was headed for an iceberg.

The other example comes from the Department of Transportation:

Transportation Secretary Ray LaHood announced a $54.6 million loan to Kansas City Southern Railway Company (KCSR) for the purchase of 30 new General Electric ES44AC locomotives. These diesel-electric locomotives, built in Erie, Pennsylvania, will help KCSR meet increasing economic demand, and are more energy-efficient and produce significantly less carbon emissions than the locomotives they are replacing.

That’s nice. Railroads have had a very nice couple of years, and with the absence of KeystoneXL, are likely to have even more business, at least in the short term. Kansas Southern has a $7.8 billion market cap. It’s already carrying $1.6 billion in debt. Its quarterly depreciation expense is almost $50 million, or just about the size of the loan. Its operating cash flow was $170 million last quarter, and it showed a net income of $300 million. And it’s not as though GE is going to file for bankruptcy protection if it doesn’t get a $50 million order.

This from the same administration who reflexively defends a perfectly reasonable accounting change (see The Death of LIFO) by attacking oil companies, rather than by defending the change on its own merits.

The problem with both of these stories is that the finance is bound up inextricably with the politics. Analysts work by examining the underlying economic return, and to the extent that there are regulatory issues, they ought at least to be predictable or bounded. Companies getting regulatory benefits they can’t use, or subsidies they don’t need, don’t do anything to help create real wealth.

First Thing, Let’s Crash All The Banks

Posted by Joshua Sharf in Business, Finance, PPC on October 31st, 2011

The latest idea from MoveOn.org and their friends and OWS is to withdraw all their money from the “Wall Street Banks,” and to move it to smaller, community banks and credit unions on November 5th. If such a move were to take place on the scale they’d like, it would be a deliberately created bank run on the largest financial institutions in the country. They seem to have gotten the scheme from some Ron Paul supporters, who are at a minimum mildly ticked off that OWS and MoveOn are claiming credit for it.

They may claim that this is a small, symbolic action, but that doesn’t excuse it. Small, symbolic actions are unlikely to have any actual effect on large institutions, and fanatics don’t propose such actions hoping for them to be merely symbolic.

We can all be grateful that this won’t amount to a hill of beans in this crazy world, but this is still a terrible idea, one whose ineffectualness doesn’t absolve it of its fundamental irresponsibility. You might expect this sort of thing from MoveOn, but the Ron Paul people fancy that they understand how banks work, and that turning all of Wall Street into the Fidelity Fiduciary Bank wouldn’t be the soundest financial strategy. Bringing Wells Fargo crashing down isn’t any better an idea now than it was 3 years ago, and it’s liable to take a bunch of smaller, “safer” community banks with it.

The basic premise of the exercise is flawed. It’s certainly true that the balance sheets of some of the larger banks are in worse shape than many smaller, community banks. And it’s equally true that Too Big to Fail probably means Too Big (to borrow a phrase from Instapundit), and that any bank Too Big To Fail should probably be broken up into smaller entities. And when smaller banks fail, they fail less catastrophically.

Ironically, the website for the Move Your Money Project features a scene from “It’s a Wonderful Life,” the bank run scene, on a building and loan that, if you remember, came within $2 and the goodwill of a couple of neighbors of failing.

Smaller banks do fail, almost 300 between 2009 and 2010, and 86 so far this year. The MYMP site will cheerfully direct you to a smaller bank or credit union, one which stands a good chance of operating under some sort of enforcement action from the Office of Thrift Supervision, the Office of the Controller of the Currency, the Fed, or the FDIC.

Ultimately, this isn’t about “sending a message” to Wall Street, or making your money safer. It’s about visceral hatred of banks and bankers, and a failure to appreciate the role that finance plays in a healthy capitalist system.

Yaron Brook, who runs the Ayn Rand institute and is nobody’s idea of a Keynesian squish, has the appropriate response:

Obama’s Evergreen Goes Brown

Posted by Joshua Sharf in 2012 Presidential Race, Business, Economics, Finance, National Politics, PPC on July 28th, 2011

Barack Obama and Harry Reid may not be able to produce a spending plan, but at least they have their old campaign talking points from 2008 to fall back on.

With the Senate having failed to produce a budget in over 2 years, the President’s budget having succeeded in uniting Washington to a degree not seen since it was under threat of attack 150 years ago, and neither willing to commit a spending plan to paper, they can be relied on to Blame Bush!

The White House has put out a graphic purporting to show that – surprise! – 8 years under President Bush added more to the national debt than 2 years under President Obama. (They play with the numbers, by assuming that the cut in marginal tax rates didn’t stimulate growth, for instance.) That President Bush wasn’t exactly a fiscal conservative like FDR isn’t a secret to anyone. In its day, what was seen as recklessness spawned Porkbusters, the Tea Party in embryo.

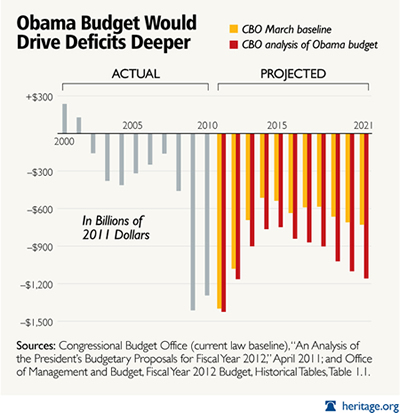

But let me remind you of this chart, originally in the Washington Post:

It’s been updated by the Heritage Foundation:

Much as Babe Ruth redefined baseball by showing what could be done when you try to hit home runs, so has Obama redefined deficit spending by showing what happens when you really put your heart and soul into it. You’ll notice, by the way, that the latter graph compares the CBO to itself, rather than to the White House budget, because, haha, there isn’t a White House budget.

Note also how the color bars in each graph look the same, only they’re shifted to the right by two years in the update. It’s evident that 2010 and 2011 haven’t worked out as planned. It’s no wonder that Tea Partiers don’t really believe in out-year cuts; the deficit reduction hasn’t occurred because Obama’s policies and those of Congressional Democrats have stifled economic growth, and because they’ve been happy to govern illegally, without a budget for two years, leaving federal spending essentially on auto-pilot.

The other argument you hear is that Paul Ryan’s budget made use of the same accounting trick that Harry Reid’s budget-avoidance bill does: counting savings from the Iraq and Afghanistan wars we won’t be fighting. But Ryan’s plan was an actual budget. There were always holes, but the difference between “will spend” and “would have spent” means a lot less when you’re drafting an actual plan, than the difference between “will spend” and “will take in.” Ryan applied that $1,000,000,000,000 to a headline.

Reid proposes to let the President spend it between now and Election Day 2012.

The Democrats won’t produce a budget because they can’t, only they don’t want you to know that until after the election. So much for them.

The Tea Party folks have a different complaint, namely that Boehner’s Plan doesn’t go far enough. I’d like to see more cuts, too. But the idea, as I recall, was to use the debt ceiling deadline as a means for forcing a debate, forcing changes to the spending that is current and planned. It was never realistic to run the entire federal government out of the House of Representatives.

To that extent, the plan has been wildly successful. It has exposed the Democrats as dangerously delusional about the state of our finances, whose only current idea is to soak you to ratify a massive increase in the scope of our economy directly controlled by the government. The Boehner Plan re-adjusts the baseline, keeps the debate on the front burner pretty much through the election, and does it without raising taxes. These are major victories, and they would not have been possible without the Tea Party. Period.

That said, this particular fight is one of many. Pushing too hard right now, bringing on a technical default, or, more likely, putting incredible discretionary power in the hands of a teenage president, won’t be Sherman marching through Georgia, it’ll be Napoleon marching to Moscow.

There is considerable frustration abroad that we can’t simply win this thing already. But politics isn’t about that. Regardless, we’ll have to keep watching, pushing, and prodding. There aren’t any final victories in politics, either over the other party or within your own. The best use of this battle is to pocket the gains, and use the process to help prepare the battlefield for the next fight.