Posts Tagged Debt Ceiling

Debt Markets React to Washington – Finally

Posted by Joshua Sharf in Business, PPC, President 2012 on July 29th, 2011

People have noted the failure to demand higher yields for treasuries, and concluded that the debt markets don’t believe there’s any problem with August 2, or 10, or any other date we care to mention. In fact, this was largely out of disbelief that Washington could fail to act.

In fact, this week, the debt markets have begun to react. Banks are beginning to pull money out of treasury-heavy money market funds, which in turn are selling treasuries and putting their money in banks. This has the effect of reducing the financial flexibility of each. The repo market – where financial institutions lend securities money to one another, using treasuries as collateral – is beginning to demand higher interest rates. Companies that don’t even like debt are issuing short-term commercial paper to make sure they have cash on hand. Let’s not turn this into panic – it’s not. But the markets are beginning to take prudent and overdue steps to protect themselves against a loss of liquidity in treasuries, even if it doesn’t mean technical default.

In the meantime, it appears that Speaker Boehner has agreed to a stricter Balanced Budget Amendment requirement for the 2nd round of cuts & debt limit increases – requiring passage rather than just a vote. I think this is a mistake.

There is every indication that Boehner Plan 2.0 was pretty close to the plan that he and Harry Reid presented to the President on Sunday, and which he indicated he would veto. But a close reading of the tea leaves also indicates that he was hoping that a strong enough statement against it would prevent him from actually having to make that decision. If he had signed it, it would have strengthened the conservative case for governance immensely.

Now, the House has probably made it more likely that they will end up voting on – and probably passing – some compromise between McConnell and Reid. That deal would, in fact, work towards marginalizing the Tea Party groups who have done so much to get us to this point.

I hope I’m wrong, and that the wording of the BBA is something that can get passed – it requires no presidential signature – and that the extra time we’re buying is put to good use making the case for it. Certainly Obama & the Democrats’ desire to run the federal budget on auto-pilot helps in that regard.

But if not, and if the 30 or so Republicans end up setting the stage for an exact repeat of this in 6 months, with no BBA in hand, they may well end up moving the debate to the left, rather than to the right.

One other point – I do think reasoned analyses such as McArdle’s, which show what will likely happen if we don’t raise the ceiling, without the histrionics, actually help our case down the road. If the markets do shudder a little bit, it should server as a spectre of what will actually happen, for real, when the debt markets finally decide to take that decision out of Washington’s hands altogether.

UPDATE: The Dollar-denominated Swiss Franc ETF, FXF, opened almost 2% higher this morning, and stayed there the whole day. I went back and looked, and since 2006, the daily percentage change has been bigger than this – in this direction – only 10 days, so this is definitely a multi-sigma event. One guess as to why it happened.

Obama’s Evergreen Goes Brown

Posted by Joshua Sharf in 2012 Presidential Race, Business, Economics, Finance, National Politics, PPC on July 28th, 2011

Barack Obama and Harry Reid may not be able to produce a spending plan, but at least they have their old campaign talking points from 2008 to fall back on.

With the Senate having failed to produce a budget in over 2 years, the President’s budget having succeeded in uniting Washington to a degree not seen since it was under threat of attack 150 years ago, and neither willing to commit a spending plan to paper, they can be relied on to Blame Bush!

The White House has put out a graphic purporting to show that – surprise! – 8 years under President Bush added more to the national debt than 2 years under President Obama. (They play with the numbers, by assuming that the cut in marginal tax rates didn’t stimulate growth, for instance.) That President Bush wasn’t exactly a fiscal conservative like FDR isn’t a secret to anyone. In its day, what was seen as recklessness spawned Porkbusters, the Tea Party in embryo.

But let me remind you of this chart, originally in the Washington Post:

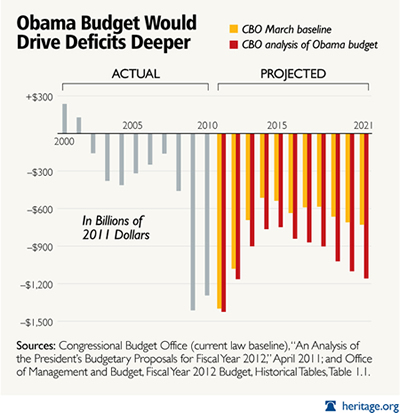

It’s been updated by the Heritage Foundation:

Much as Babe Ruth redefined baseball by showing what could be done when you try to hit home runs, so has Obama redefined deficit spending by showing what happens when you really put your heart and soul into it. You’ll notice, by the way, that the latter graph compares the CBO to itself, rather than to the White House budget, because, haha, there isn’t a White House budget.

Note also how the color bars in each graph look the same, only they’re shifted to the right by two years in the update. It’s evident that 2010 and 2011 haven’t worked out as planned. It’s no wonder that Tea Partiers don’t really believe in out-year cuts; the deficit reduction hasn’t occurred because Obama’s policies and those of Congressional Democrats have stifled economic growth, and because they’ve been happy to govern illegally, without a budget for two years, leaving federal spending essentially on auto-pilot.

The other argument you hear is that Paul Ryan’s budget made use of the same accounting trick that Harry Reid’s budget-avoidance bill does: counting savings from the Iraq and Afghanistan wars we won’t be fighting. But Ryan’s plan was an actual budget. There were always holes, but the difference between “will spend” and “would have spent” means a lot less when you’re drafting an actual plan, than the difference between “will spend” and “will take in.” Ryan applied that $1,000,000,000,000 to a headline.

Reid proposes to let the President spend it between now and Election Day 2012.

The Democrats won’t produce a budget because they can’t, only they don’t want you to know that until after the election. So much for them.

The Tea Party folks have a different complaint, namely that Boehner’s Plan doesn’t go far enough. I’d like to see more cuts, too. But the idea, as I recall, was to use the debt ceiling deadline as a means for forcing a debate, forcing changes to the spending that is current and planned. It was never realistic to run the entire federal government out of the House of Representatives.

To that extent, the plan has been wildly successful. It has exposed the Democrats as dangerously delusional about the state of our finances, whose only current idea is to soak you to ratify a massive increase in the scope of our economy directly controlled by the government. The Boehner Plan re-adjusts the baseline, keeps the debate on the front burner pretty much through the election, and does it without raising taxes. These are major victories, and they would not have been possible without the Tea Party. Period.

That said, this particular fight is one of many. Pushing too hard right now, bringing on a technical default, or, more likely, putting incredible discretionary power in the hands of a teenage president, won’t be Sherman marching through Georgia, it’ll be Napoleon marching to Moscow.

There is considerable frustration abroad that we can’t simply win this thing already. But politics isn’t about that. Regardless, we’ll have to keep watching, pushing, and prodding. There aren’t any final victories in politics, either over the other party or within your own. The best use of this battle is to pocket the gains, and use the process to help prepare the battlefield for the next fight.