Who says real estate’s been a bad investment over the last few years? Not if you’re buying midwestern farmland.

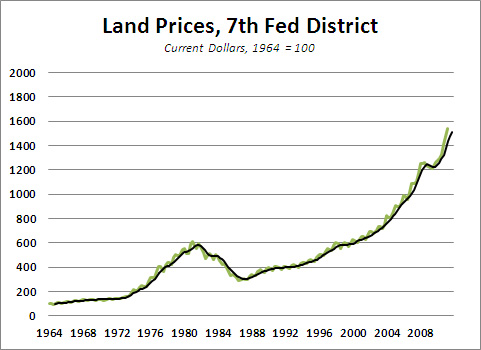

The Chicago Fed puts out a quarterly survey of farmland prices, and this past quarter, prices were up 17%, year-over-year. Here’s what the chart looks like since 1964:

A couple of words on how this chart was derived. The Fed’s survey only lists quarter-to-quarter and year-over-year changes, not the raw number, and the data for download is only the year-over-year change, rounded to the nearest percentage point. So I had to work backward, getting the last four quarter-to-quarter changes, and then backing out the annual changes for each year. As a result, I can’t tell whether there’s an actual seasonality to land prices (which wouldn’t surprise me) or that annual dip is a result of some small variation in a recent year, that gets carried backwards (which also wouldn’t surprise me). Thus the prominence of the 1-year moving average.

You can see the bubble starting around 1976, popping in 1981, and taking until about 1986 to return to the trend line. Those of you hoping to recoup your recent residential real estate losses – sorry.

You also see the line take a nice bend upwards about 2002 or so, hits a little hiccup in 2008, and then resumes the trend. There are a few reasons for this: consolidations of small family farms into large operations plays a role, as do the expanding suburbs. Unike houses, they can’t build more farmland. Recently, you can add to that better-fed Chinese, who are buying lots of American corn to feed their soon-to-be mooshu pork.

All of which goes to explain why it’s a terrible idea to be sending about 1/3 of our corn crop to ethanol. Farmers may like them, the ethanol industry couldn’t survive without them, but the demand subsidies – the requirements that a certain percentage of our fuel come from ethanol – are clearly helping to drive up the price of corn, and the price of the means of production of that corn, and its sometime substitute, soybeans.

(As mentioned before, it also drives up the price of natural gas, needed for the fertilizer that soil-depleting corn needs, in order to grow year after year on the same plot of soil.)

People borrow to buy farmland, too. The interest rates on farmland loans have been trending downward for a long time, and have been mostly under 6% for the last 10 years.

Suffice it to say, this is not going to end well.